Table of Contents:

Youngtimers-Aktie verliert: Massives Investment in Bitcoin-Mining

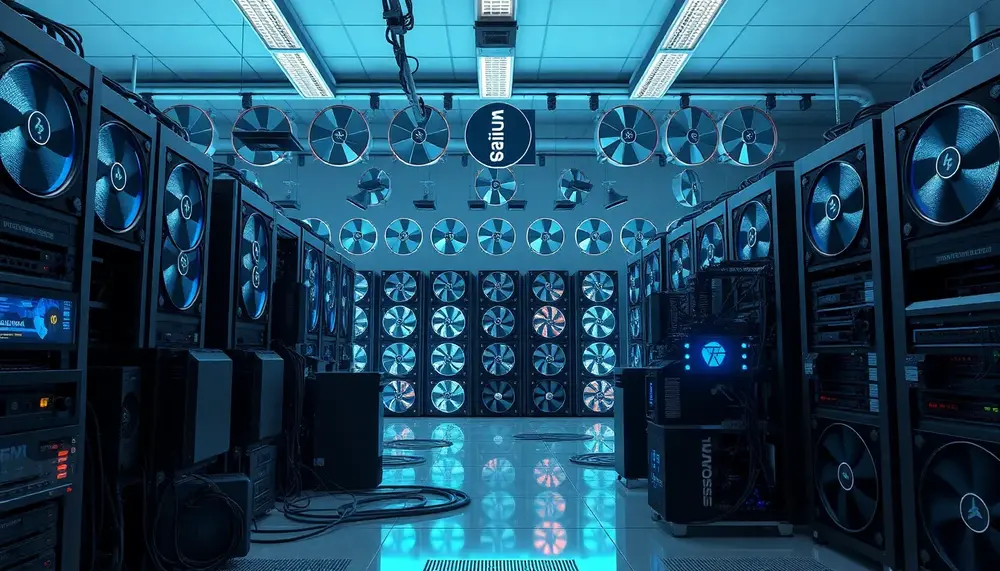

The investment company Youngtimers is entering the Bitcoin mining sector with a significant move. They plan to acquire 600 units of Bitcoin mining equipment, which is expected to be operational by the first quarter of 2026. The total investment volume amounts to approximately $6 million, with $3 million coming from the company's own funds and the remaining $3 million financed through external capital.

Youngtimers is collaborating with its strategic shareholder, DL Holdings Group Limited, a company already active in the Bitcoin mining sector. CEO Ben Cheng stated that this step reflects the company's long-term confidence in Bitcoin and the potential of blockchain technology. Additionally, he emphasized that Switzerland offers favorable conditions for innovations in the field of digital assets. Youngtimers claims to be the first company listed on the Swiss stock exchange SIX to implement a Bitcoin-related treasury strategy.

Get $500 free Bitcoin mining for a free testing phase:

- Real daily rewards

- 1 full month of testing

- No strings attached

If you choose to buy after testing, you can keep your mining rewards and receive up to 20% bonus on top.

"We believe in the long-term potential of Bitcoin and the blockchain technology," said CEO Ben Cheng.

Key Takeaways: Youngtimers is investing $6 million in Bitcoin mining, with plans to operate 600 units by 2026. The company collaborates with DL Holdings Group and aims to leverage Switzerland's favorable conditions for digital assets.

Tom Lee says Bitcoin's bottom has been reached, parabolic phase ahead

Tom Lee, a prominent figure in the cryptocurrency space, confirmed on CNBC that the bottom for Bitcoin and cryptocurrencies has been reached, suggesting a potential parabolic price increase is on the horizon. He highlighted that on-chain activities are showing a strong recovery in demand, and the price structure of Bitcoin reflects past cyclical lows.

Lee's bullish outlook is supported by a decrease in volatility and an increase in network activity, indicating organic demand. He noted that the sentiment among traders has shifted positively, with expectations of a parabolic phase dominating the market mood. This change in sentiment is crucial as it often precedes significant price movements.

"The bottom for Bitcoin and crypto is in, and prices are about to go parabolic," Tom Lee stated during his CNBC appearance.

Key Takeaways: Tom Lee believes Bitcoin has reached its bottom, with signs of a potential parabolic price increase. Increased demand and positive market sentiment support this bullish outlook.

Bitcoin hashrate drops sharply due to winter storm in the USA

The Bitcoin hashrate has experienced a significant drop of 12% following a severe winter storm in the USA, which forced many mining operations to shut down. This decline is attributed to temporary shutdowns rather than miner exits or network failures, highlighting the vulnerability of Bitcoin mining to extreme weather conditions.

Mining facilities in Texas and northern states faced icy temperatures and power grid strains, leading operators to proactively shut down their machines to prevent hardware damage and avoid power penalties. This coordinated response had immediate effects on network security and block production, marking the largest contraction in hashrate since 2021.

"The recent winter storm has shown how susceptible Bitcoin mining is to extreme weather," noted analysts.

Key Takeaways: The Bitcoin hashrate fell by 12% due to a winter storm, marking the largest drop since 2021. The incident underscores the operational risks faced by miners in extreme weather conditions.

Sources: