Table of Contents:

Understanding Crypto Mining: The Basics

Crypto mining is the process of using computer power to solve complex mathematical problems. This process is crucial for maintaining the security and integrity of blockchain networks. By solving these problems, miners validate transactions and add them to the blockchain, ensuring that the network remains decentralized and secure.

At its core, crypto mining involves using specialized hardware to perform calculations. These calculations are necessary to find a specific number, known as a "hash," which meets the network's difficulty requirements. Once a miner finds this hash, they earn the right to add a new block to the blockchain and receive a reward in the form of cryptocurrency.

Get $500 free Bitcoin mining for a free testing phase:

- Real daily rewards

- 1 full month of testing

- No strings attached

If you choose to buy after testing, you can keep your mining rewards and receive up to 20% bonus on top.

For beginners, it's important to understand that crypto mining is not just about earning digital coins. It's also about contributing to the network's overall health and security. As more miners participate, the network becomes more robust, making it harder for malicious actors to compromise the system.

The Role of Crypto Mining in Blockchain

Crypto mining plays a vital role in the blockchain ecosystem. It ensures that transactions are verified and added to the blockchain in a secure manner. This process is fundamental to maintaining the decentralized nature of cryptocurrencies, as it prevents any single entity from controlling the network.

One of the key functions of crypto mining is to prevent double spending. This occurs when someone tries to use the same cryptocurrency unit in multiple transactions. By validating transactions and recording them on the blockchain, miners help ensure that each coin is spent only once.

Additionally, crypto mining contributes to the creation of new coins. As miners solve mathematical puzzles, they are rewarded with newly minted cryptocurrency. This process not only incentivizes miners to participate but also controls the supply of new coins entering the market, which can impact the overall value of the cryptocurrency.

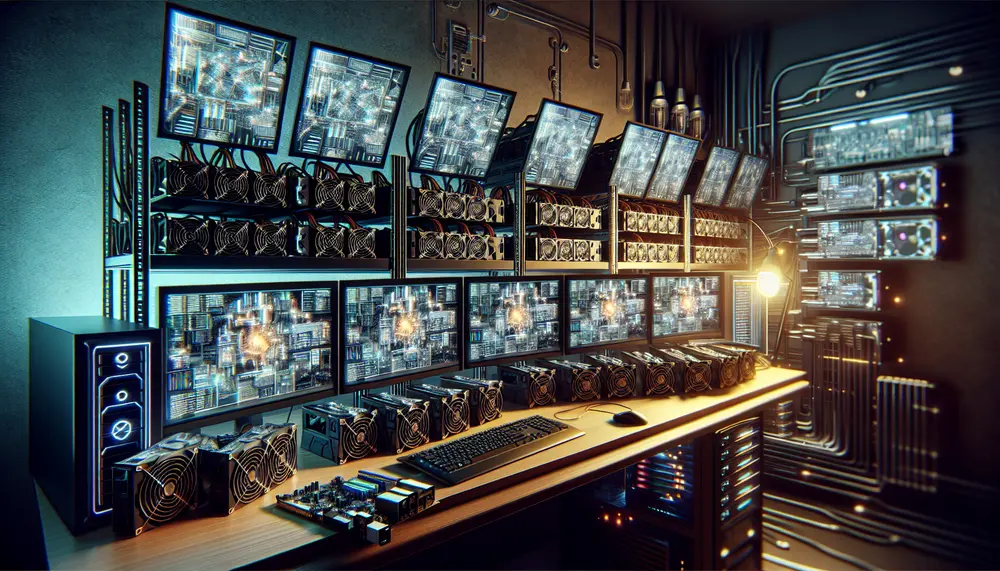

Essential Equipment for Crypto Mining

To embark on a crypto mining journey, having the right equipment is crucial. The choice of hardware can significantly impact your mining efficiency and profitability. Here are the essential components you need to consider:

- Graphics Processing Unit (GPU): GPUs are widely used in crypto mining due to their ability to handle complex calculations efficiently. They are especially popular for mining altcoins like Ethereum.

- Application-Specific Integrated Circuit (ASIC): ASICs are specialized devices designed for mining specific cryptocurrencies. They offer higher performance and efficiency compared to GPUs but are less versatile.

- Power Supply Unit (PSU): A reliable PSU is essential to provide stable power to your mining rig. It's important to choose a PSU that can handle the power requirements of your hardware.

- Cooling System: Mining generates a lot of heat, so a good cooling system is necessary to prevent overheating and ensure the longevity of your equipment.

- Mining Software: The right software is needed to connect your hardware to the blockchain network and manage the mining process. Popular options include CGMiner and BFGMiner.

Investing in quality equipment can enhance your mining experience and improve your chances of success. As you set up your mining operation, consider the balance between cost, efficiency, and potential returns.

How Crypto Mining Validates Transactions

Crypto mining is integral to the validation of transactions within a blockchain network. This process ensures that all transactions are legitimate and prevents fraudulent activities. Here's how it works:

When a transaction is initiated, it is grouped with others into a block. Miners then compete to solve a complex mathematical puzzle, known as a proof-of-work problem. This puzzle involves finding a hash that meets specific criteria set by the network. The solution is represented as a mathematical formula, such as:

Hash(Block Header) < Target

Once a miner successfully solves the puzzle, the block is validated and added to the blockchain. This process is known as consensus, as it requires agreement from the majority of miners in the network. The validated block is then broadcasted to all nodes, ensuring that the transaction is recorded across the entire network.

By requiring miners to solve these puzzles, the network ensures that only legitimate transactions are added to the blockchain. This mechanism also deters malicious actors, as altering a block would require redoing the proof-of-work for all subsequent blocks, making it computationally impractical.

Different Methods of Crypto Mining

Crypto mining has evolved over the years, and there are now several methods available for miners to choose from. Each method has its own advantages and challenges, making it important for miners to select the one that best suits their needs and resources.

- CPU Mining: This was the original method used for mining cryptocurrencies. It involves using a computer's central processing unit (CPU) to perform mining tasks. However, due to its low efficiency and profitability, CPU mining is now largely obsolete for most cryptocurrencies.

- GPU Mining: As mentioned earlier, GPUs are widely used for mining due to their superior processing power compared to CPUs. They are particularly effective for mining altcoins and are favored by hobbyists and small-scale miners.

- ASIC Mining: ASICs are specialized devices designed for mining specific cryptocurrencies. They offer high efficiency and speed, making them ideal for large-scale mining operations. However, their lack of versatility means they can only be used for the cryptocurrency they are designed for.

- Cloud Mining: This method allows individuals to rent mining hardware from a provider. It eliminates the need for purchasing and maintaining equipment, making it accessible for beginners. However, cloud mining can involve higher costs and potential risks, such as fraud.

- Mining Pools: By joining a mining pool, miners combine their computational power to increase their chances of solving blocks. Rewards are distributed among pool members based on their contribution, providing a more stable income stream.

Each mining method has its own set of requirements and potential returns. It's essential for miners to evaluate their goals, budget, and technical expertise before deciding on the most suitable approach.

The Economics of Crypto Mining

The economics of crypto mining can be complex, as it involves several factors that influence profitability. Understanding these elements is crucial for anyone considering entering the mining space.

One of the primary considerations is the cost of electricity. Mining requires significant energy consumption, and electricity costs can vary widely depending on location. Miners in regions with lower electricity rates often have a competitive advantage.

Another important factor is the price of the cryptocurrency being mined. As market prices fluctuate, so does the potential revenue from mining. High prices can lead to increased profitability, while a market downturn can make mining less lucrative.

Additionally, the network difficulty plays a role in determining mining rewards. As more miners join the network, the difficulty increases, requiring more computational power to solve blocks. This can impact the time and resources needed to earn rewards.

It's also essential to consider the initial investment in mining equipment. High-performance hardware can be costly, and miners must weigh these expenses against potential returns. The depreciation of equipment over time is another factor that can affect overall profitability.

Finally, miners should be aware of any regulatory considerations in their region. Some areas have specific laws or taxes related to crypto mining, which can impact the financial viability of a mining operation.

By carefully analyzing these economic factors, miners can make informed decisions and optimize their operations for maximum profitability.

Joining a Mining Pool: Pros and Cons

Joining a mining pool is a popular strategy for many crypto miners, especially those who are just starting out. By pooling resources, miners can increase their chances of earning rewards. However, this approach comes with its own set of advantages and disadvantages.

- Pros:

- Increased Probability of Success: By combining computational power, mining pools can solve blocks more frequently than individual miners, leading to more consistent earnings.

- Steady Income: Pool members receive a share of the rewards based on their contribution, providing a more predictable income stream compared to solo mining.

- Lower Variability: Mining pools reduce the impact of luck on earnings, as rewards are distributed more evenly among participants.

- Cons:

- Fees: Most mining pools charge a fee for participation, which can reduce overall profitability. It's important to consider these costs when evaluating potential earnings.

- Centralization Risk: Large mining pools can lead to centralization, which goes against the decentralized ethos of cryptocurrencies. This can also increase the risk of a 51% attack on the network.

- Less Control: Pool members have less control over the mining process and must rely on the pool operator to manage operations and distribute rewards fairly.

For many miners, the benefits of joining a pool outweigh the drawbacks, especially when starting with limited resources. However, it's crucial to research and choose a reputable pool that aligns with your goals and values.

Considerations for Beginner Crypto Miners

For beginners entering the world of crypto mining, there are several key considerations to keep in mind. These factors can help you navigate the complexities of mining and set you on the path to success.

- Research and Education: Before diving into mining, it's essential to educate yourself about the different cryptocurrencies, mining methods, and market trends. Understanding the basics will help you make informed decisions.

- Initial Investment: Assess your budget and determine how much you are willing to invest in mining equipment. Start with a setup that matches your financial capacity and allows for potential upgrades as you gain experience.

- Energy Costs: Consider the cost of electricity in your area, as it can significantly impact your profitability. Look for ways to optimize energy consumption, such as using energy-efficient hardware or mining during off-peak hours.

- Risk Management: Crypto mining involves financial risks, including market volatility and equipment depreciation. Diversify your investments and be prepared for potential losses.

- Community Engagement: Join online forums and communities to connect with other miners. Engaging with experienced miners can provide valuable insights, tips, and support as you start your mining journey.

By considering these factors, beginner miners can better prepare themselves for the challenges and opportunities in the crypto mining space. Taking a thoughtful and strategic approach will increase your chances of success and help you achieve your mining goals.

Conclusion: Is Crypto Mining the Right Choice for You?

Deciding whether crypto mining is the right choice for you depends on several personal and financial factors. As you consider entering this dynamic field, reflect on your goals, resources, and risk tolerance.

- Financial Goals: Determine if your primary aim is to earn a profit, support the blockchain network, or simply learn more about cryptocurrencies. Your objectives will guide your approach and investment level.

- Resource Availability: Assess whether you have access to affordable electricity, sufficient capital for equipment, and the technical skills needed to manage a mining operation.

- Risk Tolerance: Crypto mining involves inherent risks, including market volatility and regulatory changes. Consider whether you are comfortable with these uncertainties and prepared for potential losses.

- Time Commitment: Mining requires ongoing attention to hardware maintenance, software updates, and market conditions. Ensure you have the time and dedication to manage these aspects effectively.

If you find that crypto mining aligns with your interests and capabilities, it can be a rewarding endeavor. However, it's crucial to approach it with a well-researched strategy and realistic expectations. By weighing the pros and cons and considering your personal circumstances, you can make an informed decision about whether crypto mining is the right path for you.

FAQ about Crypto Mining for Beginners

What is crypto mining and why is it important?

Crypto mining is the process of using computer power to solve complex mathematical problems to validate transactions and maintain blockchain networks. It is crucial because it ensures the security and integrity of cryptocurrencies, preventing issues like double spending.

What equipment do I need for crypto mining?

To start crypto mining, you'll need specialized hardware such as a Graphics Processing Unit (GPU) or an Application-Specific Integrated Circuit (ASIC), a power supply unit (PSU), a cooling system, and mining software to manage the process.

How does crypto mining validate transactions?

Crypto mining involves solving a proof-of-work problem to validate a block of transactions. Once solved, this block is added to the blockchain, ensuring that all transactions are legitimate and preventing fraud.

What are the different methods of crypto mining?

Mining methods include CPU mining, GPU mining, ASIC mining, cloud mining, and joining mining pools. Each method has its own advantages and challenges that cater to different resources and goals.

Is joining a mining pool a good idea for beginners?

For beginners, joining a mining pool can increase the chance of earning rewards by pooling resources with other miners. While it can lead to more consistent earnings, it also involves fees and potential centralization risks.