Table of Contents:

Introduction

Understanding USDT mining fees is crucial for anyone involved in cryptocurrency transactions. These fees can significantly impact your overall costs and profitability. This article aims to break down the different types of fees associated with USDT mining, explain the factors that influence these fees, and provide strategies to minimize them. Whether you're a beginner or an experienced miner, this guide will help you navigate the complexities of USDT mining fees.

What Are USDT Mining Fees?

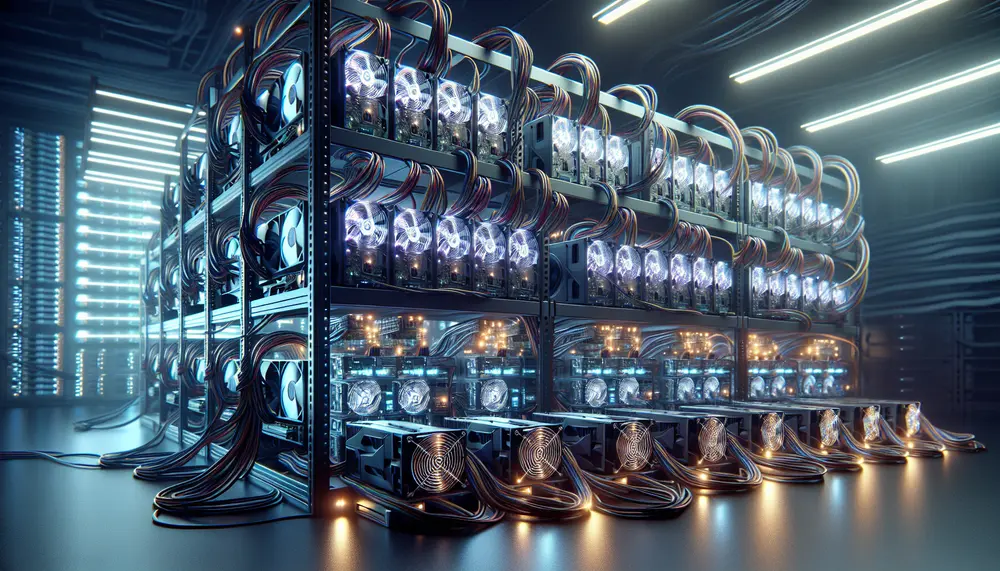

USDT mining fees are the costs associated with processing and confirming transactions on the blockchain. When you send or receive USDT, miners validate and record these transactions. For their work, miners receive a fee. This fee compensates them for the computational power and resources they use.

Get $500 free Bitcoin mining for a free testing phase:

- Real daily rewards

- 1 full month of testing

- No strings attached

If you choose to buy after testing, you can keep your mining rewards and receive up to 20% bonus on top.

These fees are not fixed and can vary based on several factors. Understanding these fees is essential for managing your costs effectively. Let's dive deeper into the different types of USDT mining fees and what influences them.

Types of USDT Mining Fees

There are several types of USDT mining fees that you should be aware of. Each type of fee serves a different purpose and can impact your overall transaction costs. Here are the main types:

- Transaction Fees: These are the fees paid to miners for processing and confirming your USDT transactions. The amount can vary based on network congestion and the blockchain used.

- Withdrawal Fees: When you withdraw USDT from an exchange or wallet, you may incur a withdrawal fee. This fee is usually fixed and depends on the platform you are using.

- Deposit Fees: Some platforms charge a fee when you deposit USDT into your account. This fee is less common but can still affect your overall costs.

- Network Fees: These are fees associated with the specific blockchain network (e.g., Ethereum, Tron) that your USDT transaction uses. Different blockchains have different fee structures.

Understanding these types of fees can help you make informed decisions and manage your USDT transactions more effectively.

Factors Affecting USDT Mining Fees

Several factors can influence the amount you pay in USDT mining fees. Understanding these factors can help you predict and manage your costs more effectively. Here are the key factors:

- Network Congestion: When the blockchain network is busy, fees tend to rise. More transactions mean higher competition for miners' attention, leading to increased fees.

- Blockchain Type: Different blockchains have different fee structures. For example, Ethereum (ERC-20) fees are generally higher than those on Tron (TRC-20).

- Transaction Size: Larger transactions may incur higher fees. This is because they require more computational power to process.

- Priority Level: Some platforms allow you to choose the priority of your transaction. Higher priority often means higher fees but faster processing times.

- Exchange Policies: Different exchanges have different fee structures for deposits, withdrawals, and transactions. Always check the fee policy of your chosen platform.

By understanding these factors, you can better plan your transactions and choose the most cost-effective options available.

Comparing USDT Fees Across Different Blockchains

USDT can be transacted on multiple blockchains, each with its own fee structure. Comparing these fees can help you choose the most cost-effective option for your needs. Here’s a breakdown of USDT fees across different blockchains:

- Ethereum (ERC-20): Known for its high security but also higher fees. Transaction fees can vary significantly based on network congestion.

- Tron (TRC-20): Generally offers lower fees compared to Ethereum. It’s a popular choice for those looking to minimize costs.

- Binance Smart Chain (BEP-20): Provides a balance between cost and speed. Fees are usually lower than Ethereum but slightly higher than Tron.

- Polygon (ERC-20): Offers low fees and fast transaction times. It’s a Layer-2 solution on Ethereum, making it a cost-effective alternative.

- AVAX C-Chain (ERC-20): Another cost-effective option with lower fees and fast processing times.

- The Open Network: Known for its minimal fees and quick transactions, making it an attractive option for many users.

By comparing these options, you can select the blockchain that best meets your needs in terms of cost and efficiency. Always consider both the fee structure and the transaction speed when making your choice.

How to Minimize USDT Mining Fees

Minimizing USDT mining fees can help you save money and make your transactions more efficient. Here are some strategies to reduce these costs:

- Choose the Right Blockchain: Opt for blockchains with lower fees, such as Tron (TRC-20) or Binance Smart Chain (BEP-20). These networks often offer more cost-effective transactions compared to Ethereum (ERC-20).

- Monitor Network Congestion: Execute transactions during off-peak times when the network is less congested. This can result in lower fees.

- Use Exchanges with Low Fees: Compare different exchanges and choose those with lower withdrawal and transaction fees. Platforms like Binance and Cropty often have competitive fee structures.

- Batch Transactions: If possible, combine multiple transactions into one. This can reduce the overall fee by spreading it across several transfers.

- Leverage Layer-2 Solutions: Utilize Layer-2 solutions like Polygon, which offer lower fees and faster transaction times compared to Layer-1 blockchains.

By implementing these strategies, you can effectively reduce your USDT mining fees and make your transactions more cost-efficient.

Conclusion

Understanding and managing USDT mining fees is essential for anyone involved in cryptocurrency transactions. By knowing the different types of fees and the factors that influence them, you can make informed decisions and optimize your costs. Comparing fees across various blockchains and implementing strategies to minimize these fees can significantly enhance your overall transaction efficiency.

Whether you are a beginner or an experienced user, the key is to stay informed and proactive. By choosing the right blockchain, monitoring network congestion, and leveraging cost-effective platforms, you can keep your USDT mining fees to a minimum. This will allow you to maximize your returns and ensure smoother, more economical transactions.

Frequently Asked Questions about USDT Mining Fees

What are USDT mining fees?

USDT mining fees are the costs associated with processing and confirming transactions on the blockchain. Miners receive these fees as compensation for validating and recording transactions.

What types of fees are involved in USDT transactions?

The main types of USDT fees include transaction fees, withdrawal fees, deposit fees, and network fees, each serving a different purpose and affecting overall transaction costs.

What factors influence USDT mining fees?

USDT mining fees are influenced by network congestion, blockchain type, transaction size, priority level, and exchange policies.

How can I minimize USDT mining fees?

To minimize USDT mining fees, choose blockchains with lower fees like TRC-20 or BEP-20, execute transactions during off-peak times, use exchanges with low fees, batch transactions, and leverage Layer-2 solutions like Polygon.

How do USDT fees compare across different blockchains?

USDT fees differ across blockchains; Ethereum (ERC-20) generally has higher fees, Tron (TRC-20) offers lower fees, Binance Smart Chain (BEP-20) provides balanced cost and speed, while Polygon and AVAX C-Chain are cost-effective with fast transaction times.