Table of Contents:

Trump's Bitcoin Mining Business Plans IPO

According to IT-Boltwise, the American Bitcoin Corp., a company formed through the majority acquisition of American Data Centers, is preparing for an initial public offering (IPO). This development was announced by Asher Genoot, CEO of Hut 8, the majority stakeholder in the new company. Hut 8, a Canadian firm already listed on the stock exchange since 2018, holds 80% of the shares in American Bitcoin and has transferred its ASIC miners to the new entity.

Hut 8 will act as the exclusive infrastructure and operations partner for American Bitcoin, with long-term commercial agreements in place. The company aims to establish itself as a major player in the cryptocurrency sector, with plans to hold mined Bitcoins as a strategic reserve. Eric Trump, one of the founders of American Data Centers, emphasized that there are no conflicts of interest, as he has always worked in the private sector.

Get $500 free Bitcoin mining for a free testing phase:

- Real daily rewards

- 1 full month of testing

- No strings attached

If you choose to buy after testing, you can keep your mining rewards and receive up to 20% bonus on top.

“The Trumps have positioned themselves as prominent supporters of cryptocurrencies,” IT-Boltwise reports, highlighting Eric Trump's enthusiasm for Bitcoin and his father's initiatives to promote the crypto industry.

Key Takeaways:

- American Bitcoin Corp. plans an IPO to strengthen its market position.

- Hut 8 holds 80% of the company and will manage infrastructure and operations.

- The company aims to maintain a strategic Bitcoin reserve.

Bitcoin Market Under Pressure from Trump's Tariff Plans

As reported by Der Aktionär, the cryptocurrency market faced significant losses following the announcement of new tariffs by former US President Donald Trump. The tariffs, set to take effect on April 5, include a 10% import duty on goods from nearly 200 trade partners, with some countries facing rates as high as 49%. This policy led to a 3.1% drop in the overall crypto market within 24 hours, with Bitcoin falling 5% to $83,200.

Altcoins were hit even harder, with Ethereum dropping over 6% to nearly $1,800 and Solana losing 6.5%, now trading at approximately $118. Alexander Blume, CEO of Two Prime Digital Assets, noted that the tariffs could increase production costs for Bitcoin miners reliant on Chinese ASIC chips. However, he also suggested that the situation might drive more capital into assets like Bitcoin and gold as safe havens.

Key Takeaways:

- Bitcoin dropped 5% to $83,200 following tariff announcements.

- Altcoins like Ethereum and Solana experienced even steeper declines.

- Higher tariffs on Chinese ASIC chips could impact mining profitability.

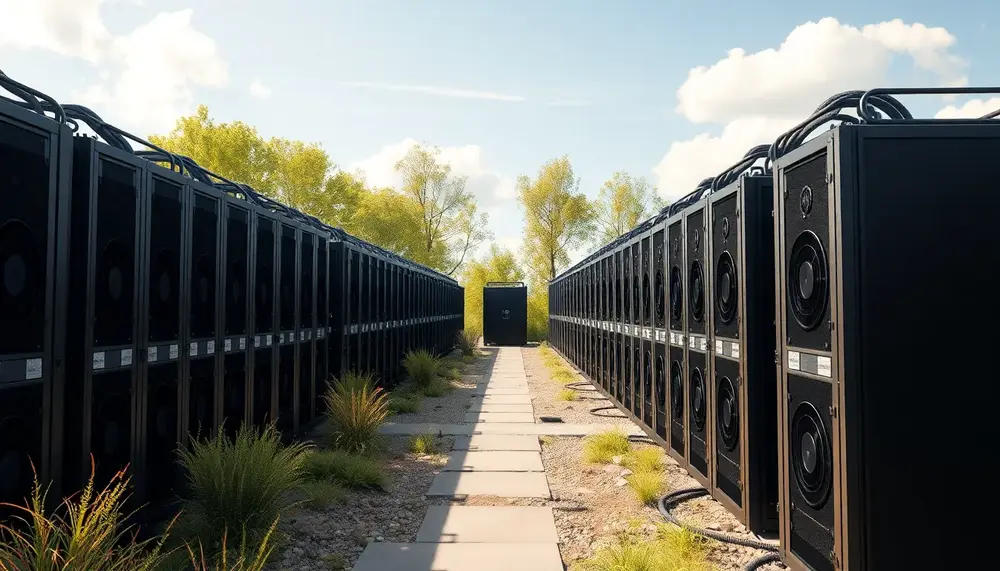

Hyperscale Data Expands Bitcoin Mining Operations in Michigan

IT-Boltwise reports that Hyperscale Data, through its subsidiary Sentinum, has mined a total of 3,061 Bitcoins since operations began in March 2021. In the first quarter of 2025 alone, the company mined 56 Bitcoins. To enhance efficiency and scalability, Hyperscale Data plans to relocate the majority of its mining operations to a new high-performance data center in Michigan.

CEO William B. Horne emphasized the strategic importance of this move, which aims to optimize infrastructure and meet growing market demands. The Michigan facility will also support emerging technologies like artificial intelligence, requiring robust and scalable infrastructure.

Key Takeaways:

- Sentinum has mined 3,061 Bitcoins since March 2021.

- Plans are underway to relocate operations to Michigan for better efficiency.

- The new facility will support both Bitcoin mining and AI technologies.

Bitfarms Secures $300 Million for HPC Development

According to IT-Boltwise, Bitfarms has entered into a $300 million financing agreement with the Macquarie Group to develop high-performance computing (HPC) centers. The first $50 million will be allocated to the Panther Creek data center in Pennsylvania, which will have a capacity of nearly 500 megawatts. The remaining funds will be released upon achieving specific development milestones.

Bitfarms mined 654 Bitcoins in the last quarter of 2024 at an average cost of $60,800 per Bitcoin. The company retains a significant portion of its mined Bitcoins, making it one of the top 25 publicly traded Bitcoin investors. Additionally, Bitfarms is addressing regulatory challenges and plans to acquire Stronghold Digital Mining for $125 million to expand its capacity.

Key Takeaways:

- Bitfarms secured $300 million for HPC development.

- The Panther Creek facility will have a capacity of 500 megawatts.

- The company retains a significant portion of its mined Bitcoins.

Hut 8 and American Bitcoin Forge New Mining Partnership

IT-Boltwise highlights a strategic partnership between Hut 8 and American Bitcoin Corp., involving Eric and Donald Trump Jr. This collaboration aims to create the largest and most efficient Bitcoin mining operation. Hut 8 has transferred its ASIC miners to American Bitcoin, which will now oversee all mining activities. Meanwhile, Hut 8 will remain the exclusive infrastructure and operations partner.

The leadership team includes Mike Ho as Executive Chairman, Matt Prusak as CEO, and Eric Trump as Chief Strategy Officer. The partnership focuses on building a strategic Bitcoin reserve and setting new standards for efficiency and sustainability in the mining sector.

Key Takeaways:

- Hut 8 and American Bitcoin aim to become the largest Bitcoin miner.

- Eric Trump serves as Chief Strategy Officer for American Bitcoin.

- The partnership emphasizes efficiency and strategic Bitcoin reserves.

Sources:

- Bitcoin Mining Unternehmen sichert sich private Kreditfazilität mit Macquarie Einheit

- Trumps Bitcoin-Mining-Geschäft plant Börsengang

- Bitcoin: Kryptomarkt nach Trumps Zollplänen unter Druck

- Hyperscale Data plant Expansion der Bitcoin-Mining-Operationen in Michigan

- Bitfarms sichert sich 300 Millionen Dollar für HPC-Entwicklung

- Hut 8 und American Bitcoin: Neue Wege im Bitcoin-Mining