Table of Contents:

Introduction to Bitcoin Mining Profitability

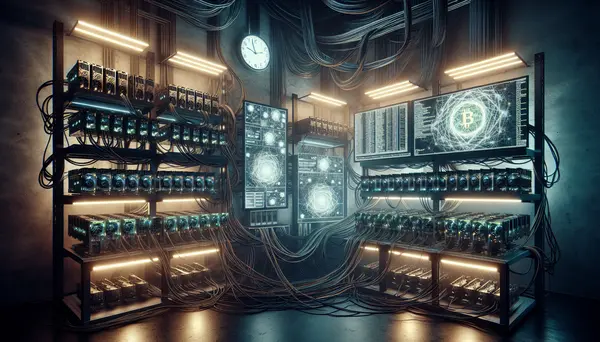

Before delving into the heart of making money with Bitcoin, it's important to understand what Bitcoin mining is. Bitcoin mining is the process of creating new bitcoins by solving complex mathematical equations. This process not only creates new bitcoins but also verifies transactions on the Bitcoin network. Notably, it's this mechanism that has been the backbone of the currency's decentralized nature.

The profitability of Bitcoin mining, on the other hand, consists of the returns made from mining operations. The costs of mining hardware, electricity, and cooling equipment are factored in when considering Bitcoin mining profitability. This guide aims to provide a comprehensive understanding of the various factors that impact Bitcoin mining's profitability, creating a foundation for those considering getting into this potentially lucrative venture.

Get $500 free Bitcoin mining for a free testing phase:

- Real daily rewards

- 1 full month of testing

- No strings attached

If you choose to buy after testing, you can keep your mining rewards and receive up to 20% bonus on top.

Understanding Bitcoin Mining

Let's dig a bit deeper into the world of Bitcoin mining. Essentially, every time a transaction is made with Bitcoin, it's added to a kind of digital ledger known as the blockchain. Here's where Bitcoin miners step in: they use powerful computers to solve complex problems that allow them to add these transactions to the blockchain. Once the problem is solved, new Bitcoins are created and the miner is awarded a certain number of them as a reward. This is how new Bitcoins come into existence - quite a different experience from how traditional currency is created!

Pros and Cons of Bitcoin Mining Profitability

| Aspect | Pros | Cons |

|---|---|---|

| Potential Earnings | High profitability if Bitcoin price increases | Losses if Bitcoin price falls |

| Hardware Costs | One-time purchase | High upfront costs |

| Operational Costs | Can be mitigated with renewable energy sources | High electricity bills |

| Market Volatility | Potential for high returns | High risk, price can drastically fall |

| Regulation | Could provide stability | Tight regulations can restrict profitability |

Investment Required for Bitcoin Mining

Bitcoin mining requires a significant initial investment. The first cost you'll encounter is the price of a Bitcoin mining machine. These machines are high-powered computers designed to solve the complex mathematical problems that validate Bitcoin transactions. Their cost varies depending on their processing power, known as their hash rate. The higher the hash rate, the more complex problems a machine can solve and the more Bitcoins it can earn.

The second major cost is electricity. Bitcoin mining machines consume a lot of power. Therefore, you'll need to consider your local electricity rates when calculating your potential profits. Some miners move their operations to locations where electricity is cheaper to increase their profit margins.

Lastly, these machines generate a lot of heat, so you'll also need to invest in cooling systems to prevent your machines from overheating and failing. You need proper infrastructure and maintenance to ensure your mining operation runs smoothly.

Factors Affecting Bitcoin Mining Profitability

When it comes to Bitcoin mining profitability, several factors come into play. One of these is the Bitcoin price. As the value of Bitcoin increases, so does the potential profit from mining it. However, price can be volatile, leading to potential losses if the value of Bitcoin drops significantly.

Another factor is the Bitcoin block reward. When a miner successfully adds a transaction to the blockchain, they are rewarded with a certain amount of Bitcoin. This reward halves approximately every four years in an event known as "the halving". As the reward decreases over time, making a profit from mining becomes more challenging.

The third factor that affects profitability is the difficulty level of mining. The more miners there are competing to solve the mathematical puzzles that validate transactions and create new Bitcoins, the harder these puzzles become. This, in turn, increases the need for more powerful - and expensive - equipment, which can reduce profitability.

Lastly, the operational costs involved in running the mining hardware also significantly impact profitability. This includes not only the power costs but also cooling, maintenance, and other related expenses.

A Final Thought on Bitcoin Mining Profitability

Bitcoin mining can be a lucrative venture, but it's not without its challenges. Profitability isn't guaranteed and it can vary greatly depending on a number of factors. However, with careful planning, the right equipment, and a thorough understanding of the dynamic Bitcoin market, successful and profitable mining is certainly achievable. If you're considering entering the world of Bitcoin mining, keep these factors in mind and make sure to do your homework before taking the plunge.

Case Study: Bitcoin Mining Profitability

Case studies provide a lense to look at real situations, adding depth to our understanding. Let's consider John, a novice Bitcoin miner.

John decides to invest in a Bitcoin mining machine. He spends $2,000 on a machine with decent processing power. His local electricity provider charges him around 10 cents per kilowatt-hour. Adding maintenance and cooling costs, John spends about $100 a month.

John's machine works around the clock, mining Bitcoin. It helps verify transactions on the blockchain network, for which John gets rewarded in Bitcoin. Remember, miners earn less Bitcoin as rewards over time because of an event called the halving. But John is committed and understands this cycle.

After a month, John calculates his profits. He's earned some Bitcoin, but when he subtracts his operational costs, he finds he's just broken even. This is where the Bitcoin price comes in. Luckily for John, Bitcoin's value has been on an upward trend, and when he sells the Bitcoin he's earned, he makes a profit.

John's story shows us that while it can be tough initially, with the right set up and a bit of luck with Bitcoin value, mining can lead to profits. It's key to note that every miner's experience will be unique due to differing costs and Bitcoin market performance.

Calculating Potential Returns

Now, you may wonder, how can I estimate my potential earnings from Bitcoin mining? It's not as complex as you might think. Let's break it down.

First, know the hash rate of your mining machine. This is the number of calculations your machine can make per second. It's the speed at which your miner can solve those mathematical puzzles we mentioned earlier. The higher your hash rate, the more puzzles you can solve, and the more Bitcoin you can earn.

Next, consider the power consumption of your equipment. This is measured in watts. You'll need to multiply this by the number of hours you plan to mine each day and the cost per kilowatt-hour (kWh) in your area. This gives you your daily electricity cost for mining.

Then, take into account the current Bitcoin price and the block reward– the amount of Bitcoin you'll earn each time a new block is added to the blockchain. Remember, the block reward halves every four years.

Also, keep in mind the mining difficulty. The more miners competing for block rewards, the more complex the puzzles become.

By considering all these factors, you can estimate your potential earnings. There are also many online Bitcoin mining profitability calculators available. They can save you time and ensure your calculations are more accurate.

Remember, the result is an estimate. Bitcoin's price and mining difficulty fluctuate, so your actual returns may vary. But with this knowledge at hand, you're well-equipped to make informed decisions about whether to jump into the world of Bitcoin mining.

Risks Involved in Bitcoin Mining

While it seems like a rewarding venture, Bitcoin mining comes with several risks. The first is its high start-up cost. Mining hardware, combined with the cost of electricity and cooling systems, can make a significant dent in your wallet. Furthermore, the return on this investment is not instant and depends on the current Bitcoin price, mining difficulty, and block reward.

Another risk involves regulatory changes. Governments around the world continue to grapple with how to regulate cryptocurrencies like Bitcoin. Any adverse regulatory changes can impact the profitability of Bitcoin mining.

Moreover, as the competition in Bitcoin mining increases, it gets more difficult to mine Bitcoins. The increased difficulty can lead to less profitability and higher electricity costs.

Lastly, there's the risk of technical failures. Mining equipment can fail or become outdated, requiring additional investment to replace or upgrade it. Also, mining is an online venture, so you could face issues like network failure or hacking attempts.

All these challenges highlight the need for interested individuals to meticulously evaluate their readiness, both in terms of finances and knowledge, before venturing into Bitcoin mining. An understanding of these risks will pave the way for a more balanced and measured approach to this venture.

Tips to Increase Bitcoin Mining Profitability

Boosting your Bitcoin mining profitability might feel challenging, but don't worry. Here are a few tips to help you maximize your earnings.

Firstly, consider joining a mining pool. A mining pool is a group of miners who combine their computing power to solve blocks faster. The rewards are then shared amongst the members of the pool. By joining a pool, you can earn a more stable income than mining alone.

Next, keep a close eye on your operating costs. Every penny you save on electricity is an extra penny in profit. Consider sourcing for cheaper electricity suppliers or even moving to a location where electricity is less expensive. Remember also that newer mining equipment is often more energy-efficient than older models.

Lastly, stay updated with the latest Bitcoin news. Changes in the Bitcoin market, such as price fluctuations or regulatory updates, can directly impact your profitability. Being aware of these changes can allow you to make strategic decisions, like whether to hold or sell your Bitcoin.

Remember, the successful Bitcoin miner is not only technically savvy but also an astute businessperson. Balancing technical expertise with financial acumen will make your venture into Bitcoin mining rewarding.

Conclusion: Is Bitcoin Mining Profitable for You?

In conclusion, taking a deep dive into Bitcoin mining profitability requires assessing your personal scenario. The primary considerations should revolve around operational costings, including hardware and power, the prevailing Bitcoin price, and mining difficulty levels. Understanding your local power costs will help paint a clearer picture of the potential gains or losses.

On a broader scale, keenly watching trends in the Bitcoin market and staying informed about the currency's volatility, and the occurrence of halving events may provide advantageous insights. Most importantly, your willingness and ability to bear possible financial risks will also determine if this venture will be worthwhile for you.

In essence, while Bitcoin mining has the potential to offer significant returns, it also comes with its own set of challenges and risks. Therefore, the decision to venture into Bitcoin mining should take into account these considerations and should be approached from an informed perspective.

Understanding the Profitability of Bitcoin Mining

What is Bitcoin mining?

Bitcoin mining is the process of creating new bitcoins by solving complex mathematical problems and confirming transactions on the Bitcoin blockchain using high-power computers.

How profitable is Bitcoin mining?

The profitability of Bitcoin mining depends on several factors including the cost of electricity, the cost of your mining hardware, the difficulty of the mining algorithm and the current price of Bitcoin.

What affects mining profitability?

Key factors affecting mining profitability include the cost of mining hardware, electricity costs, the difficulty of the mining algorithm, and the market price of Bitcoin.

How can one increase the profitability in Bitcoin mining?

Optimizing the mining operation by selecting efficient mining equipment, using renewable energy or locating operations in areas with lower electricity costs, and joining mining pools can increase profitability.

What is the future of Bitcoin mining?

The future of Bitcoin mining will continue to be influenced by factors such as technological advancements, regulatory developments, and market demand for Bitcoin. However, the exact future of Bitcoin mining remains uncertain.