Posts on the Topic Regulations

A successful Bitcoin mining facility requires choosing an optimal location with reliable, affordable energy and supportive regulations, investing in advanced cooling technologies to boost efficiency, maximizing operational efficiency through smart power management and automation, and embracing sustainable energy practices like...

Norway's energy landscape is predominantly powered by renewable sources like water and wind, making it a strategic location for mining operations; however, staying informed about fluctuating electricity prices and potential regulatory changes is crucial. Engaging with local stakeholders and leveraging...

Australia is an ideal location for mining pools due to its stable political and economic environment, abundant renewable energy resources, tech-savvy workforce, robust internet infrastructure, and clear regulatory framework. Mining pools in Australia offer efficiency through resource sharing, higher success...

Kenya's mining tax structure is complex, balancing government revenue with not overburdening miners, while cryptocurrency mining presents unique taxation challenges due to its intangible nature and high energy consumption. Potential solutions include non-income-based taxes on energy use, training programs for...

Mining tax consultants play a crucial role in the cryptocurrency sector by providing expertise on complex tax codes, ensuring compliance with evolving regulations, and offering strategic financial insights to help businesses navigate volatile markets and minimize tax liabilities. Their specialized...

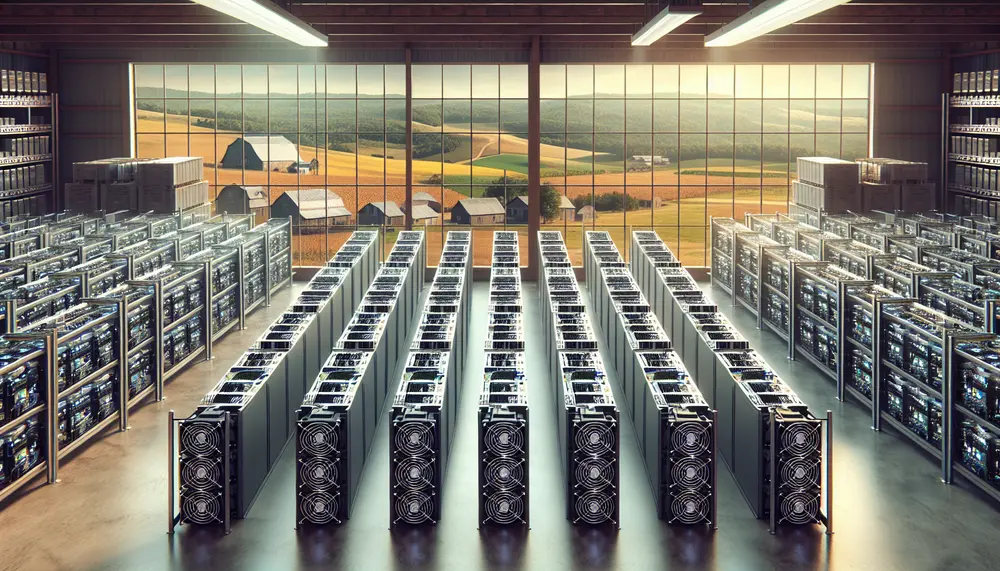

Cryptocurrency mining has evolved from simple laptop operations to complex, large-scale data center activities focused on efficiency and sustainability, with FX Crypto Mine Xplore leading innovations in hybrid mining models, renewable energy use, and compliance with regulatory changes. By integrating...

In 2023, mining profitability is influenced by Bitcoin's price, mining difficulty, electricity costs, hardware efficiency, and regulatory changes. Technological advancements like ASICs and AI are enhancing operations while sustainable practices and cloud mining gain traction; the Bitcoin halving event impacts...

Setting up a crypto mining server involves selecting optimal hardware like GPUs or ASICs, building infrastructure with adequate power and cooling, installing suitable software, and ensuring legal compliance for efficient operations. This process requires careful planning to optimize performance while...

The Supreme Court's ruling allowing Indian states to levy retroactive mining taxes from 2005 has reshaped the financial landscape, offering fiscal opportunities for mineral-rich regions while posing significant challenges and potential liabilities for major mining corporations. This decision enhances state...

Cryptocurrency mining, particularly Bitcoin, poses zoning challenges for city planners and lawmakers who must balance its economic benefits with environmental and community impacts. The American Planning Association aids in navigating these issues by providing resources to ensure responsible integration of...

Mining tax exemptions allow companies to reduce their financial burdens, enhancing profitability and sustainability while encouraging economic growth through strategic mineral production. Understanding the legal framework and meeting specific eligibility criteria are crucial for mining companies to effectively leverage these...

The article provides a guide to simplifying mining tax payments by understanding obligations, leveraging technology like accounting software and cloud solutions, consulting with professionals for expert advice, staying updated on tax rate changes through newsletters and government announcements, maintaining timely...

The legality of crypto mining varies globally, with countries adopting different regulations based on economic interests and environmental concerns; miners must navigate these laws to ensure compliance. Understanding financial and environmental regulations is crucial for miners to avoid legal challenges...

In 2024, crypto mining profitability hinges on factors like hardware efficiency, electricity costs, market value of cryptocurrencies, and regulatory environments; miners must leverage technological advancements and manage operational expenses to optimize their strategies. Staying informed about industry trends and joining...