Table of Contents:

Introduction

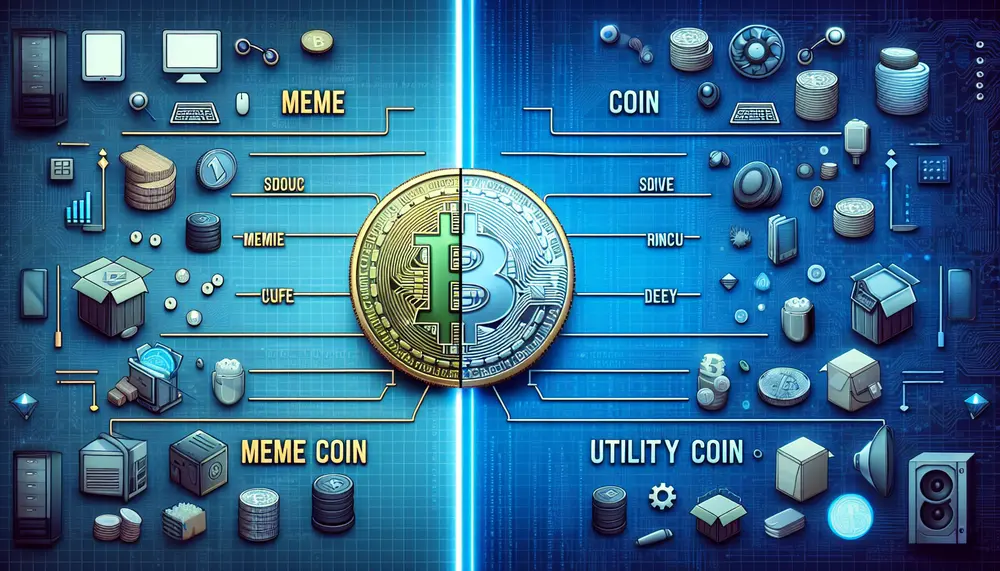

In the world of cryptocurrency, there are many different types of coins and tokens. Two of the most talked-about categories are meme coins and utility coins. Understanding the key differences between these two can help you make better investment decisions and navigate the crypto market more effectively. This article will break down what meme coins and utility coins are, their use cases, and their potential risks and rewards. Whether you're a beginner or an experienced investor, this guide will provide valuable insights into the unique characteristics of each type of coin.

What are Meme Coins?

Meme coins are a type of cryptocurrency that originated as a joke or a parody. They often gain popularity through social media and online communities. Unlike traditional cryptocurrencies, meme coins usually lack a serious purpose or underlying technology. Instead, they rely on viral marketing and community support to drive their value.

Get $500 free Bitcoin mining for a free testing phase:

- Real daily rewards

- 1 full month of testing

- No strings attached

If you choose to buy after testing, you can keep your mining rewards and receive up to 20% bonus on top.

One of the most famous examples of a meme coin is Dogecoin, which started as a parody of Bitcoin but gained a massive following. Meme coins are often characterized by their humorous or whimsical nature, and they can experience rapid price fluctuations due to their speculative nature.

Despite their origins, some meme coins have evolved to include more serious applications and functionalities. However, their primary appeal remains their entertainment value and the strong communities that form around them.

What are Utility Coins?

Utility coins, also known as utility tokens, are a type of cryptocurrency designed to provide access to a specific product or service within a blockchain ecosystem. Unlike meme coins, utility coins have a clear purpose and are often integral to the functionality of a platform or application.

These coins are used to pay for services, access features, or participate in governance within their respective ecosystems. For example, Ethereum's native token, ETH, is used to pay for transaction fees and computational services on the Ethereum network. Similarly, Binance Coin (BNB) is used to pay for trading fees on the Binance exchange.

Utility coins are essential for the operation of decentralized applications (dApps) and smart contracts. They often have a more stable value compared to meme coins, as their demand is tied to the usage and success of the underlying platform. This makes them a crucial component in the broader cryptocurrency landscape.

History and Popularity

The history and popularity of meme coins and utility coins offer fascinating insights into the evolution of the cryptocurrency market. Meme coins, like Dogecoin, started as a joke in 2013 but quickly gained traction due to their humorous nature and strong community support. Their popularity surged in 2021, driven by social media hype and endorsements from celebrities like Elon Musk.

On the other hand, utility coins have a more structured and purpose-driven history. Ethereum, launched in 2015, introduced the concept of smart contracts and decentralized applications (dApps), revolutionizing the blockchain space. This innovation paved the way for other utility coins, each designed to solve specific problems or enhance the functionality of their respective platforms.

The popularity of these two types of coins varies significantly. Meme coins often experience rapid and volatile price movements, attracting speculative investors looking for quick gains. In contrast, utility coins tend to attract long-term investors who believe in the potential of the underlying technology and its applications.

Despite their differences, both meme coins and utility coins have carved out unique niches in the cryptocurrency market. Their distinct characteristics and use cases continue to attract diverse groups of investors and enthusiasts.

Use Cases and Applications

The use cases and applications of meme coins and utility coins highlight their fundamental differences and unique roles in the cryptocurrency ecosystem.

Meme coins primarily serve as a form of entertainment and community engagement. Their value is often driven by social media trends, memes, and online communities. While some meme coins have attempted to introduce more practical applications, their primary use case remains speculative trading and community-driven projects. For example, Dogecoin has been used for tipping content creators online and fundraising for charitable causes, leveraging its strong community support.

In contrast, utility coins have a wide range of practical applications within their respective ecosystems. These coins are essential for accessing services, paying for transaction fees, and participating in governance on blockchain platforms. Some common use cases include:

- Transaction Fees: Utility coins like ETH are used to pay for transaction fees on the Ethereum network.

- Access to Services: Binance Coin (BNB) is used to pay for trading fees on the Binance exchange, often at a discounted rate.

- Governance: Utility tokens can grant holders voting rights on platform decisions, such as protocol upgrades or feature implementations.

- Staking: Some utility coins can be staked to earn rewards or participate in securing the network.

These diverse applications make utility coins an integral part of the blockchain ecosystem, driving their demand and value based on the success and adoption of the underlying platforms.

Examples of Popular Meme Coins

There are several popular meme coins that have captured the attention of the cryptocurrency community. These coins often gain fame through viral marketing and strong community support. Here are some notable examples:

- Dogecoin (DOGE): Launched in 2013 as a parody of Bitcoin, Dogecoin has become one of the most well-known meme coins. It gained significant attention in 2021, thanks to endorsements from celebrities and widespread social media coverage. Despite its origins as a joke, Dogecoin has a loyal community and has been used for charitable donations and online tipping.

- Shiba Inu (SHIB): Inspired by Dogecoin, Shiba Inu was created in 2020 and quickly gained popularity as the "Dogecoin killer." It features a decentralized exchange called ShibaSwap and has a large, active community. SHIB has seen substantial price movements, driven by its community and social media presence.

- Floki Inu (FLOKI): Named after Elon Musk's dog, Floki Inu started as a meme coin but has since evolved into a more serious project. It aims to develop a Web3 ecosystem that includes decentralized finance (DeFi), non-fungible tokens (NFTs), and a metaverse. FLOKI operates on both the Ethereum and Binance Smart Chain networks.

These examples illustrate the diverse nature of meme coins and their ability to capture the imagination of the crypto community. While they may have started as jokes, many meme coins have developed dedicated followings and unique use cases.

Examples of Popular Utility Coins

Several utility coins have become essential components of the cryptocurrency ecosystem, each serving specific functions within their respective platforms. Here are some prominent examples:

- Ethereum (ETH): Launched in 2015, Ethereum introduced the concept of smart contracts and decentralized applications (dApps). ETH is used to pay for transaction fees and computational services on the Ethereum network. It is one of the most widely used utility coins, driving a vast array of blockchain projects.

- Binance Coin (BNB): Initially created as a utility token for the Binance exchange, BNB is used to pay for trading fees, often at a discounted rate. Over time, BNB's use cases have expanded to include participation in token sales on Binance Launchpad and payment for transaction fees on the Binance Smart Chain.

- Chainlink (LINK): Chainlink provides decentralized oracle services, enabling smart contracts to interact with real-world data. LINK tokens are used to pay node operators for retrieving data from off-chain sources, ensuring the accuracy and reliability of the information provided to smart contracts.

- Uniswap (UNI): Uniswap is a decentralized exchange (DEX) that allows users to trade cryptocurrencies without intermediaries. UNI tokens are used for governance, allowing holders to vote on protocol upgrades and changes. This ensures that the community has a say in the platform's development.

These utility coins demonstrate the diverse applications and essential roles they play in the blockchain ecosystem. Their value is closely tied to the success and adoption of the platforms they support, making them integral to the ongoing growth of the cryptocurrency market.

Investment Potential and Risks

When considering the investment potential and risks of meme coins and utility coins, it's important to understand their distinct characteristics and market behaviors.

Meme coins often attract investors looking for quick gains due to their highly speculative nature. Their prices can experience extreme volatility, driven by social media trends and community hype. While this can lead to significant short-term profits, it also comes with high risks. The lack of a solid underlying technology or real-world use case means that meme coins can lose value just as quickly as they gain it. Investors should be cautious and prepared for potential losses.

On the other hand, utility coins tend to offer more stable investment opportunities. Their value is closely tied to the success and adoption of the platforms they support. For example, as the Ethereum network grows and more decentralized applications are built on it, the demand for ETH increases, potentially driving up its value. However, utility coins are not without risks. Factors such as regulatory changes, technological challenges, and competition from other projects can impact their value.

Here are some key points to consider for both types of coins:

- Volatility: Meme coins are highly volatile, offering the potential for quick gains but also significant losses. Utility coins tend to be more stable but can still experience price fluctuations based on market conditions.

- Community Support: Strong community backing can drive the value of meme coins, while utility coins benefit from the growth and success of their underlying platforms.

- Regulatory Risks: Both types of coins face regulatory risks, but utility coins may be more susceptible due to their integration with specific platforms and services.

- Long-term Potential: Utility coins often have better long-term potential due to their practical applications and essential roles in blockchain ecosystems. Meme coins may struggle to maintain value over time without continuous community engagement and hype.

Investors should carefully assess their risk tolerance and investment goals when choosing between meme coins and utility coins. Diversifying investments and staying informed about market trends can help mitigate risks and maximize potential returns.

Community and Support

The community and support behind meme coins and utility coins play a crucial role in their success and longevity. Both types of coins rely on their communities, but the nature and impact of this support can differ significantly.

Meme coins thrive on strong, active communities that drive their popularity and value. These communities often form around social media platforms like Reddit, Twitter, and Discord. The collective enthusiasm and engagement of these groups can lead to viral marketing campaigns, meme creation, and coordinated buying efforts. For example, the Dogecoin community has been instrumental in promoting the coin and organizing charitable events. The sense of camaraderie and shared humor within these communities can create a loyal and passionate user base.

In contrast, utility coins benefit from a more diverse range of support, including developers, users, and institutional investors. The success of utility coins is often tied to the growth and adoption of their underlying platforms. For instance, the Ethereum community includes developers building decentralized applications (dApps), users transacting on the network, and investors supporting the ecosystem. This multifaceted support helps drive innovation, improve technology, and expand the use cases for utility coins.

Here are some key aspects of community and support for both types of coins:

- Engagement: Meme coin communities are highly engaged and active on social media, often driving viral trends. Utility coin communities include developers, users, and investors who contribute to the platform's growth and development.

- Promotion: Meme coin communities excel at grassroots marketing and creating buzz. Utility coin communities focus on building and improving the underlying technology and expanding its use cases.

- Longevity: The long-term success of meme coins depends on sustained community interest and engagement. Utility coins benefit from ongoing development and real-world applications, which can provide more stable, long-term support.

Both meme coins and utility coins rely on their communities for support, but the nature of this support varies. Understanding these differences can help investors and users make informed decisions about which type of coin aligns with their goals and interests.

Conclusion

In conclusion, understanding the key differences between meme coins and utility coins is essential for anyone looking to navigate the cryptocurrency market effectively. Meme coins, driven by community support and social media trends, offer high-risk, high-reward investment opportunities. They are primarily valued for their entertainment factor and the strong, engaged communities that form around them.

On the other hand, utility coins have a clear purpose and are integral to the functionality of their respective blockchain platforms. Their value is closely tied to the success and adoption of these platforms, making them a more stable, long-term investment option. Utility coins benefit from a diverse range of support, including developers, users, and institutional investors, which helps drive innovation and expand their use cases.

Both types of coins have their unique advantages and risks. Meme coins can offer quick gains but come with high volatility and speculative nature. Utility coins provide more stable investment opportunities but are not without their own set of challenges, such as regulatory risks and technological hurdles.

Ultimately, the choice between meme coins and utility coins depends on your investment goals, risk tolerance, and interest in the underlying technology. By understanding the distinct characteristics and potential of each type of coin, you can make more informed decisions and better navigate the ever-evolving world of cryptocurrency.

Frequently Asked Questions about Meme Coins vs Utility Coins

What is a Meme Coin?

A Meme Coin is a type of cryptocurrency that began as a joke or parody but often gains popularity through social media and online communities. They usually lack a serious purpose or underlying technology and rely on viral marketing and community support for their value.

What is a Utility Coin?

A Utility Coin, or utility token, is a cryptocurrency designed to provide access to a specific product or service within a blockchain ecosystem. They have a clear purpose and are integral to the functionality of a platform or application, such as paying for transaction fees or services.

What are some examples of popular Meme Coins?

Popular Meme Coins include Dogecoin (DOGE), Shiba Inu (SHIB), and Floki Inu (FLOKI). These coins often gain fame through viral marketing and strong community support, and they have unique use cases despite their origins as jokes.

What are some examples of popular Utility Coins?

Popular Utility Coins include Ethereum (ETH), Binance Coin (BNB), Chainlink (LINK), and Uniswap (UNI). These coins serve specific functions within their platforms, such as paying for transaction fees, access to services, and participating in governance.

What are the investment risks and potential of Meme Coins and Utility Coins?

Meme Coins offer high-risk, high-reward investment opportunities due to their speculative nature and volatile prices driven by social media trends. Utility Coins tend to offer more stable investments, with their value tied to the success and adoption of their underlying platforms. Both types of coins carry risks, such as price volatility and regulatory challenges.