Table of Contents:

Introduction to Crypto Mining Yield

Crypto mining yield refers to the amount of cryptocurrency you can earn through mining activities. Understanding and maximizing your yield is crucial for profitability. This article will guide you through various strategies and tips to help you get the most out of your mining efforts.

By focusing on the right hardware, optimizing software settings, and managing power efficiently, you can significantly improve your crypto mining yield. Additionally, joining a mining pool and staying updated with blockchain changes are essential steps to enhance your earnings.

Get $500 free Bitcoin mining for a free testing phase:

- Real daily rewards

- 1 full month of testing

- No strings attached

If you choose to buy after testing, you can keep your mining rewards and receive up to 20% bonus on top.

We will also explore the concept of yield farming as an alternative to traditional mining, along with security measures to protect your investments. Finally, monitoring and analyzing your performance will help you make informed decisions and stay ahead in the ever-evolving world of crypto mining.

Understanding Crypto Mining Yield

To maximize your crypto mining yield, it's essential to understand what it entails. Crypto mining yield is the reward you receive for contributing computational power to a blockchain network. This reward can come in the form of newly minted coins or transaction fees.

Several factors influence your mining yield:

- Hash Rate: The speed at which your mining hardware can solve cryptographic puzzles. A higher hash rate increases your chances of earning rewards.

- Network Difficulty: This adjusts based on the total computational power of the network. Higher difficulty means it's harder to earn rewards.

- Block Reward: The number of coins given for solving a block. This can change over time due to halving events or protocol updates.

- Electricity Costs: The cost of power to run your mining hardware. Lower costs improve profitability.

- Pool Fees: If you join a mining pool, you'll need to pay a fee, which can affect your overall yield.

Understanding these factors helps you make informed decisions about your mining setup and strategy. By optimizing each element, you can enhance your crypto mining yield and achieve better returns on your investment.

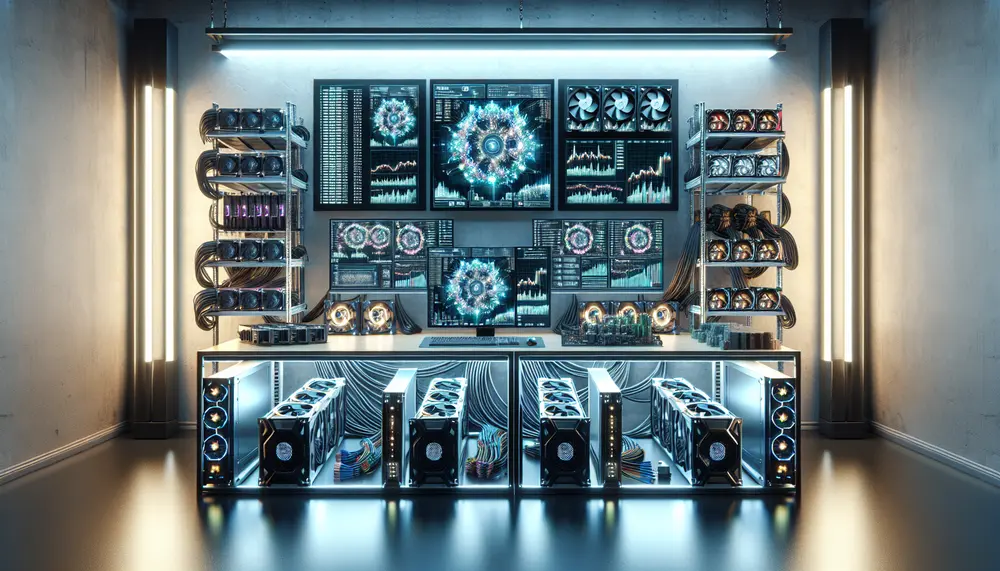

Choosing the Right Hardware

Choosing the right hardware is a critical step in maximizing your crypto mining yield. The type of hardware you select can significantly impact your mining efficiency and profitability. Here are some key considerations:

- ASIC Miners: Application-Specific Integrated Circuits (ASICs) are designed for a specific algorithm. They offer high hash rates and energy efficiency but can be expensive. ASICs are ideal for mining established cryptocurrencies like Bitcoin.

- GPUs: Graphics Processing Units (GPUs) are versatile and can mine various cryptocurrencies. They are less efficient than ASICs but offer flexibility. GPUs are suitable for mining altcoins and experimenting with different coins.

- CPUs: Central Processing Units (CPUs) are the least efficient for mining but can be used for certain algorithms. They are generally not recommended for serious mining operations due to their low hash rates.

- FPGA: Field-Programmable Gate Arrays (FPGAs) offer a balance between ASICs and GPUs. They are more efficient than GPUs and can be reprogrammed for different algorithms. However, they require technical expertise to set up and optimize.

When selecting hardware, consider the following factors:

- Hash Rate: Higher hash rates increase your chances of earning rewards.

- Energy Efficiency: Look for hardware with a high hash rate per watt to reduce electricity costs.

- Initial Cost: Balance the upfront cost of the hardware with its potential earnings.

- Resale Value: Consider the resale value of the hardware if you plan to upgrade in the future.

By carefully choosing the right hardware, you can enhance your mining efficiency and boost your crypto mining yield.

Optimizing Software Settings

Optimizing software settings is crucial for maximizing your crypto mining yield. The right software configuration can enhance your mining efficiency and increase your earnings. Here are some key steps to optimize your mining software:

- Choose the Right Mining Software: Different cryptocurrencies require different mining software. Popular options include CGMiner, BFGMiner, and EasyMiner. Ensure the software is compatible with your hardware and supports the cryptocurrency you are mining.

- Update Software Regularly: Keep your mining software up to date to benefit from the latest features, performance improvements, and security patches. Regular updates can also help you stay competitive in the mining community.

- Adjust Overclocking Settings: Overclocking your hardware can increase its hash rate. However, it also increases power consumption and heat output. Find a balance that maximizes performance without compromising hardware stability.

- Optimize Power Settings: Adjust power settings to ensure your hardware runs efficiently. Lowering the power limit can reduce electricity costs while maintaining a reasonable hash rate.

- Configure Pool Settings: If you are part of a mining pool, ensure your pool settings are optimized. This includes setting the correct pool address, port, and worker credentials. Some pools offer advanced settings like failover pools and load balancing.

Here is an example of how to configure CGMiner for Bitcoin mining:

cgminer --url=stratum+tcp://pooladdress:port --userpass=username.worker:password --gpu-engine 1100 --gpu-memclock 1500 --gpu-powertune 20

In this example, replace pooladdress, port, username, worker, and password with your specific pool details. The --gpu-engine, --gpu-memclock, and --gpu-powertune options adjust the GPU settings for optimal performance.

By fine-tuning your software settings, you can achieve higher efficiency and boost your crypto mining yield.

Efficient Power Management

Efficient power management is essential for maximizing your crypto mining yield. High electricity costs can eat into your profits, so it's crucial to manage power consumption effectively. Here are some strategies to optimize power usage:

- Use Energy-Efficient Hardware: Select mining hardware with a high hash rate per watt. This ensures you get the most computational power for the least amount of electricity.

- Optimize Cooling Systems: Proper cooling reduces the risk of overheating and improves hardware efficiency. Use fans, heat sinks, or even liquid cooling systems to maintain optimal temperatures.

- Adjust Power Limits: Many mining rigs allow you to set power limits. Lowering the power limit can reduce electricity consumption while maintaining a reasonable hash rate. For example, setting a power limit of 80% can significantly cut costs.

- Monitor Power Usage: Use power meters to track the electricity consumption of your mining rigs. This helps you identify inefficiencies and make necessary adjustments.

- Time-of-Use Pricing: Some electricity providers offer lower rates during off-peak hours. Schedule your mining activities during these times to take advantage of reduced rates.

Here is a simple formula to calculate your mining profitability considering power costs:

Profit = (Mining Revenue) · (Electricity Cost)

By managing power efficiently, you can reduce operational costs and increase your crypto mining yield. Implementing these strategies will help you achieve better profitability and sustainability in your mining operations.

Joining a Mining Pool

Joining a mining pool is a strategic move to maximize your crypto mining yield. Mining pools allow miners to combine their computational power, increasing the chances of solving blocks and earning rewards. Here are the key benefits and considerations for joining a mining pool:

- Increased Reward Frequency: By pooling resources, miners receive smaller, more frequent payouts instead of waiting for a solo mining reward. This steady income can be more predictable and less risky.

- Reduced Variance: Mining pools help reduce the variance in earnings. Instead of the "all or nothing" approach of solo mining, pool members share the rewards, leading to more consistent returns.

- Lower Entry Barrier: New miners with limited hardware can still participate and earn rewards by joining a pool. This makes mining more accessible to a broader audience.

When choosing a mining pool, consider the following factors:

- Pool Fees: Most pools charge a fee, typically ranging from 1% to 3% of the rewards. Lower fees mean higher net earnings, but ensure the pool's reliability and reputation justify the cost.

- Pool Size: Larger pools have a higher probability of solving blocks, leading to more frequent payouts. However, rewards are divided among more participants. Smaller pools may offer larger individual shares but with less frequent payouts.

- Payout Structure: Different pools use various payout methods, such as Pay-Per-Share (PPS), Proportional, or Pay-Per-Last-N-Shares (PPLNS). Understand the payout structure to choose one that aligns with your mining goals.

- Reputation and Reliability: Research the pool's history, user reviews, and uptime. A reliable pool ensures consistent payouts and minimizes downtime.

To join a mining pool, follow these steps:

- Register an account on the pool's website.

- Configure your mining software with the pool's server address, port, and your worker credentials.

- Start mining and monitor your performance through the pool's dashboard.

By joining a mining pool, you can enhance your crypto mining yield through more consistent and frequent payouts. This collaborative approach can help you achieve better returns on your mining investment.

Staying Updated with Blockchain Changes

Staying updated with blockchain changes is vital for maximizing your crypto mining yield. Blockchain networks are dynamic, with frequent updates and changes that can impact mining operations. Here are some key reasons to stay informed:

- Protocol Updates: Blockchain networks often undergo protocol updates or hard forks. These changes can affect mining algorithms, block rewards, and network difficulty. Staying informed ensures you can adjust your mining strategy accordingly.

- New Cryptocurrencies: Emerging cryptocurrencies may offer more profitable mining opportunities. Keeping an eye on new projects allows you to diversify your mining portfolio and capitalize on early adoption rewards.

- Security Vulnerabilities: Awareness of potential security vulnerabilities in the blockchain or mining software helps you take proactive measures to protect your investments. Regular updates often include security patches that safeguard your operations.

Here are some strategies to stay updated:

- Follow Official Channels: Subscribe to official blogs, forums, and social media channels of the cryptocurrencies you mine. These platforms provide timely updates on protocol changes, development progress, and community discussions.

- Join Mining Communities: Participate in online mining communities and forums. Engaging with other miners can provide valuable insights, tips, and updates on the latest trends and changes in the mining landscape.

- Use Monitoring Tools: Utilize blockchain explorers and monitoring tools to track network statistics, block rewards, and difficulty adjustments. These tools help you make informed decisions based on real-time data.

- Read Industry News: Follow reputable crypto news websites and publications. Staying informed about industry developments, regulatory changes, and technological advancements can help you adapt your mining strategy.

By staying updated with blockchain changes, you can adapt quickly to new developments and optimize your crypto mining yield. Being proactive and informed ensures you remain competitive and maximize your mining profitability.

Diversifying Across Multiple Cryptocurrencies

Diversifying across multiple cryptocurrencies is a smart strategy to maximize your crypto mining yield. By spreading your mining efforts across different coins, you can reduce risk and take advantage of various opportunities. Here are some key benefits and tips for diversification:

- Risk Mitigation: Mining a single cryptocurrency can be risky due to market volatility and potential changes in mining difficulty. Diversifying helps spread the risk and ensures that poor performance in one coin doesn't significantly impact your overall yield.

- Maximize Profitability: Different cryptocurrencies have varying levels of profitability based on factors like block rewards, network difficulty, and market value. By mining multiple coins, you can capitalize on the most profitable opportunities at any given time.

- Flexibility and Adaptability: Diversifying allows you to adapt to changes in the crypto landscape. If a particular coin becomes less profitable or faces regulatory challenges, you can shift your focus to other coins without significant disruption.

Here are some tips for effective diversification:

- Research and Select Coins: Conduct thorough research to identify promising cryptocurrencies with strong fundamentals, active development teams, and growing communities. Look for coins with a good balance of profitability and long-term potential.

- Use Multi-Coin Mining Software: Choose mining software that supports multiple cryptocurrencies. This allows you to switch between coins easily and manage your mining operations efficiently.

- Monitor Market Trends: Keep an eye on market trends and adjust your mining strategy accordingly. Use tools and platforms that provide real-time data on mining profitability, network difficulty, and market prices.

- Allocate Resources Wisely: Allocate your mining resources based on the current profitability of each coin. For example, if a particular coin offers higher rewards, dedicate more hash power to it while maintaining a balanced portfolio.

By diversifying across multiple cryptocurrencies, you can enhance your crypto mining yield and build a more resilient mining operation. This approach helps you navigate the dynamic crypto market and maximize your returns over time.

Yield Farming as an Alternative

Yield farming is an alternative strategy to traditional crypto mining that can help maximize your crypto mining yield. Yield farming involves providing liquidity to decentralized finance (DeFi) protocols in exchange for rewards, typically in the form of additional cryptocurrency tokens. Here are some key aspects of yield farming:

- Liquidity Provision: In yield farming, you deposit your crypto assets into a liquidity pool. These pools facilitate trading on decentralized exchanges (DEXs) and other DeFi platforms. In return, you earn a portion of the transaction fees and additional tokens.

- APY and APR: Yield farming returns are often expressed as Annual Percentage Yield (APY) or Annual Percentage Rate (APR). APY includes the effect of compounding, while APR does not. Higher APY or APR indicates better potential returns.

- Risk and Reward: Yield farming can offer high returns, but it also comes with risks. These include smart contract vulnerabilities, impermanent loss, and market volatility. It's essential to assess the risk-reward ratio before committing your assets.

Here are some steps to get started with yield farming:

- Choose a DeFi Platform: Research and select a reputable DeFi platform that offers yield farming opportunities. Popular platforms include Uniswap, Aave, and Compound.

- Deposit Assets: Deposit your crypto assets into the chosen liquidity pool. Ensure you understand the terms and conditions, including the lock-up period and potential fees.

- Earn Rewards: Monitor your deposited assets and track the rewards you earn. Some platforms allow you to reinvest your rewards to compound your returns.

- Withdraw and Reallocate: Periodically review your yield farming strategy. Withdraw your assets and reallocate them to different pools or platforms if better opportunities arise.

Yield farming can be a lucrative alternative to traditional mining, offering the potential for high returns. However, it's crucial to stay informed and manage risks effectively. By incorporating yield farming into your strategy, you can diversify your income streams and enhance your overall crypto mining yield.

Security Measures to Protect Your Investments

Implementing robust security measures is essential to protect your investments and maximize your crypto mining yield. The decentralized nature of cryptocurrencies makes them attractive targets for hackers and malicious actors. Here are some key security practices to safeguard your mining operations:

- Use Secure Wallets: Store your mined cryptocurrencies in secure wallets. Hardware wallets, such as Ledger and Trezor, offer enhanced security by keeping your private keys offline. Avoid storing large amounts of crypto on exchanges or online wallets.

- Enable Two-Factor Authentication (2FA): Activate 2FA on all accounts related to your mining activities, including exchanges, wallets, and mining pool accounts. This adds an extra layer of security by requiring a second form of verification.

- Keep Software Updated: Regularly update your mining software, operating system, and firmware. Updates often include security patches that protect against vulnerabilities and exploits.

- Use Strong Passwords: Create complex, unique passwords for all your accounts. Avoid using the same password across multiple platforms. Consider using a password manager to generate and store strong passwords securely.

- Monitor Network Traffic: Use network monitoring tools to detect unusual activity on your mining rigs. This can help identify potential security breaches or unauthorized access attempts.

Here are additional steps to enhance your security:

- Backup Your Data: Regularly backup your wallet data and important files. Store backups in multiple secure locations, such as encrypted external drives or cloud storage with strong encryption.

- Implement Firewalls: Use firewalls to protect your mining rigs from unauthorized access. Configure your firewall settings to block suspicious traffic and limit access to trusted IP addresses.

- Secure Remote Access: If you need remote access to your mining rigs, use secure methods such as Virtual Private Networks (VPNs) and Secure Shell (SSH) protocols. Avoid using default login credentials and change them regularly.

- Educate Yourself: Stay informed about the latest security threats and best practices. Follow reputable sources and participate in online communities to learn from other miners' experiences.

By implementing these security measures, you can protect your investments and ensure the longevity of your mining operations. A secure setup not only safeguards your assets but also contributes to a more stable and profitable crypto mining yield.

Monitoring and Analyzing Your Performance

Monitoring and analyzing your performance is crucial for maximizing your crypto mining yield. By keeping a close eye on your mining operations, you can identify inefficiencies, optimize settings, and make informed decisions. Here are some key steps to effectively monitor and analyze your mining performance:

- Use Mining Monitoring Tools: Utilize dedicated mining monitoring tools and software to track your hash rate, temperature, power consumption, and overall performance. Popular tools include Minerstat, Awesome Miner, and Hive OS.

- Track Earnings and Payouts: Regularly check your earnings and payouts from mining pools. Compare your actual earnings with expected returns to identify any discrepancies or issues.

- Analyze Hash Rate Stability: Monitor the stability of your hash rate over time. Fluctuations in hash rate can indicate hardware issues, network problems, or suboptimal settings. Aim for a consistent and stable hash rate to maximize your yield.

- Evaluate Power Efficiency: Keep an eye on your power consumption and efficiency. Use the formula

Efficiency = Hash Rate · Power Consumption

to assess how effectively your hardware is converting electricity into computational power. - Monitor Pool Performance: If you are part of a mining pool, track the pool's performance, including block discovery rate, payout frequency, and fee structure. Ensure the pool is meeting your expectations and providing a fair share of rewards.

Here are additional tips for effective performance analysis:

- Set Performance Benchmarks: Establish benchmarks for your mining rigs based on their specifications and expected performance. Use these benchmarks to measure and compare your actual performance.

- Identify and Resolve Issues: When you notice performance drops or anomalies, investigate the root cause. Common issues include overheating, hardware failures, or network connectivity problems. Address these issues promptly to maintain optimal performance.

- Optimize Mining Settings: Use the data from your monitoring tools to fine-tune your mining settings. Adjust parameters such as clock speeds, power limits, and fan speeds to achieve the best balance between performance and efficiency.

- Keep Detailed Records: Maintain detailed records of your mining activities, including hardware configurations, software settings, and performance metrics. These records can help you track progress, identify trends, and make data-driven decisions.

By consistently monitoring and analyzing your performance, you can optimize your mining operations and maximize your crypto mining yield. This proactive approach ensures you stay competitive and achieve the best possible returns on your investment.

Future Trends in Crypto Mining

The world of crypto mining is constantly evolving, and staying ahead of future trends is essential for maximizing your crypto mining yield. Here are some key trends to watch in the coming years:

- Transition to Proof of Stake (PoS): Many blockchain networks are moving from Proof of Work (PoW) to Proof of Stake (PoS) consensus mechanisms. PoS is more energy-efficient and scalable, reducing the need for extensive mining hardware. Ethereum's transition to Ethereum 2.0 is a prime example of this shift.

- Green Mining Initiatives: Environmental concerns are driving the development of more sustainable mining practices. Green mining initiatives focus on using renewable energy sources, improving energy efficiency, and reducing the carbon footprint of mining operations.

- Advanced Mining Hardware: The development of more powerful and efficient mining hardware continues to be a significant trend. Innovations in ASICs, GPUs, and even quantum computing could revolutionize mining efficiency and profitability.

- Decentralized Mining Pools: Traditional mining pools can be centralized, posing risks of single points of failure and control. Decentralized mining pools aim to distribute control and rewards more equitably, enhancing security and fairness in the mining ecosystem.

- Integration with DeFi: The integration of mining with decentralized finance (DeFi) platforms is an emerging trend. Miners can leverage DeFi protocols for yield farming, staking, and lending, creating additional revenue streams and maximizing returns.

Here are some additional trends to consider:

- Regulatory Developments: Governments and regulatory bodies are increasingly focusing on the crypto industry. New regulations could impact mining operations, including energy consumption, taxation, and compliance requirements. Staying informed about regulatory changes is crucial for long-term success.

- Interoperability Solutions: As the number of blockchain networks grows, interoperability solutions are becoming more important. These solutions enable seamless communication and transactions between different blockchains, potentially opening new opportunities for miners.

- AI and Machine Learning: The use of artificial intelligence (AI) and machine learning in mining operations is on the rise. These technologies can optimize mining strategies, predict market trends, and enhance decision-making processes.

- Community-Driven Projects: Community-driven mining projects are gaining traction. These projects prioritize decentralization, transparency, and community involvement, aligning with the core principles of blockchain technology.

By staying informed about these future trends, you can adapt your mining strategy and remain competitive in the ever-changing crypto landscape. Embracing innovation and sustainability will help you maximize your crypto mining yield and ensure long-term success.

Conclusion and Best Practices

Maximizing your crypto mining yield requires a comprehensive approach that includes selecting the right hardware, optimizing software settings, managing power efficiently, and staying updated with blockchain changes. Additionally, diversifying across multiple cryptocurrencies and exploring alternatives like yield farming can further enhance your returns.

Here are some best practices to ensure you get the most out of your mining efforts:

- Regularly Monitor Performance: Use monitoring tools to track your mining performance and make data-driven adjustments. Consistent monitoring helps identify inefficiencies and optimize your setup.

- Stay Informed: Keep up with industry news, protocol updates, and emerging trends. Staying informed allows you to adapt quickly and take advantage of new opportunities.

- Implement Strong Security Measures: Protect your investments by using secure wallets, enabling two-factor authentication, and keeping your software updated. Security is crucial for safeguarding your assets.

- Optimize Power Usage: Manage your power consumption to reduce costs and improve profitability. Use energy-efficient hardware and optimize cooling systems to maintain optimal performance.

- Join a Mining Pool: Increase your chances of earning rewards by joining a reputable mining pool. Pooling resources with other miners can lead to more consistent and frequent payouts.

- Diversify Your Mining Portfolio: Spread your mining efforts across multiple cryptocurrencies to mitigate risk and maximize profitability. Diversification helps you stay resilient in a volatile market.

By following these best practices, you can enhance your crypto mining yield and achieve better returns on your investment. The crypto mining landscape is dynamic, and staying proactive and informed is key to long-term success. Embrace innovation, prioritize security, and continuously optimize your operations to stay ahead in the competitive world of crypto mining.

FAQ on Enhancing Crypto Mining Efficiency

What is the most important factor in increasing crypto mining yield?

The most important factor is choosing the right hardware. Hardware with a high hash rate and energy efficiency will significantly enhance your mining yield.

How can power management improve mining profitability?

Efficient power management reduces operational costs. Using energy-efficient hardware, optimizing cooling systems, and lowering power limits can help cut electricity costs.

What are the benefits of joining a mining pool?

Joining a mining pool increases your chances of earning rewards more frequently and reduces the variance in earnings. It's especially beneficial for new miners with limited hardware.

How often should I update my mining software?

You should regularly update your mining software to benefit from the latest performance improvements, features, and security patches, ensuring that you stay competitive.

What is yield farming and how does it differ from traditional mining?

Yield farming involves providing liquidity to DeFi protocols in exchange for rewards, whereas traditional mining involves solving cryptographic puzzles to earn new coins. Yield farming can offer high returns but comes with unique risks.