Table of Contents:

Introduction

In this article, we will explore the profitability of Siacoin mining in 2023. Whether you are a beginner or an experienced miner, understanding the factors that influence mining profitability is crucial. We will cover everything from the basics of Siacoin to the latest hardware options available for mining. By the end of this article, you will have a clear understanding of whether Siacoin mining is a profitable venture for you in 2023.

What is Siacoin?

Siacoin (SC) is a decentralized storage platform that leverages blockchain technology to create a secure and efficient way to store data. Unlike traditional cloud storage providers, Siacoin allows users to rent out their unused hard drive space to others in exchange for SC tokens. This creates a decentralized network of storage providers, reducing costs and increasing security.

Get $500 free Bitcoin mining for a free testing phase:

- Real daily rewards

- 1 full month of testing

- No strings attached

If you choose to buy after testing, you can keep your mining rewards and receive up to 20% bonus on top.

Key features of Siacoin include:

- Decentralization: No single point of failure, enhancing data security.

- Cost Efficiency: Lower storage costs compared to traditional providers.

- Blockchain Technology: Ensures data integrity and security.

Siacoin's unique approach to data storage makes it an attractive option for both users and miners. By participating in the network, miners can earn SC tokens, which can be traded or used within the Siacoin ecosystem.

Understanding Siacoin Mining Profitability

To determine the profitability of Siacoin mining, several factors need to be considered. These include the cost of hardware, electricity, network difficulty, and the current price of Siacoin. Understanding these elements will help you make informed decisions about your mining activities.

Here are the key factors that influence Siacoin mining profitability:

- Hardware Costs: The initial investment in mining equipment, such as ASIC miners or GPUs, plays a significant role in profitability.

- Electricity Costs: Mining consumes a lot of power. The cost of electricity in your region will impact your overall profits.

- Network Difficulty: As more miners join the network, the difficulty of mining increases, which can reduce your earnings.

- Siacoin Price: The market value of Siacoin affects how much you can earn from mining. Higher prices generally lead to higher profits.

To maximize profitability, it's essential to monitor these factors regularly and adjust your mining strategy accordingly. Tools like profitability calculators can help you estimate potential earnings based on current data.

Factors Affecting Siacoin Mining Profitability in 2023

Several factors will impact the profitability of Siacoin mining in 2023. Understanding these factors can help you make better decisions and optimize your mining operations.

Here are the key factors to consider:

- Hardware Efficiency: Newer mining hardware tends to be more efficient, consuming less power while providing higher hash rates. Investing in the latest ASIC miners can improve profitability.

- Electricity Rates: The cost of electricity varies by region. Lower electricity rates can significantly increase your net profits. Consider relocating your mining operations to areas with cheaper electricity.

- Network Difficulty: The difficulty of mining Siacoin can fluctuate. Higher difficulty means more computational power is required to mine the same amount of Siacoin, which can reduce profitability.

- Market Price of Siacoin: The value of Siacoin on the market directly affects your earnings. A higher market price can make mining more profitable, while a lower price can have the opposite effect.

- Block Rewards and Transaction Fees: Miners earn rewards for each block they successfully mine, along with transaction fees. Changes in block rewards or transaction fee structures can impact profitability.

- Regulatory Environment: Government regulations on cryptocurrency mining can affect operational costs and legal compliance. Stay informed about any regulatory changes in your region.

By keeping an eye on these factors and adapting your strategy, you can enhance your chances of achieving profitable Siacoin mining in 2023.

Latest Hardware for Siacoin Mining

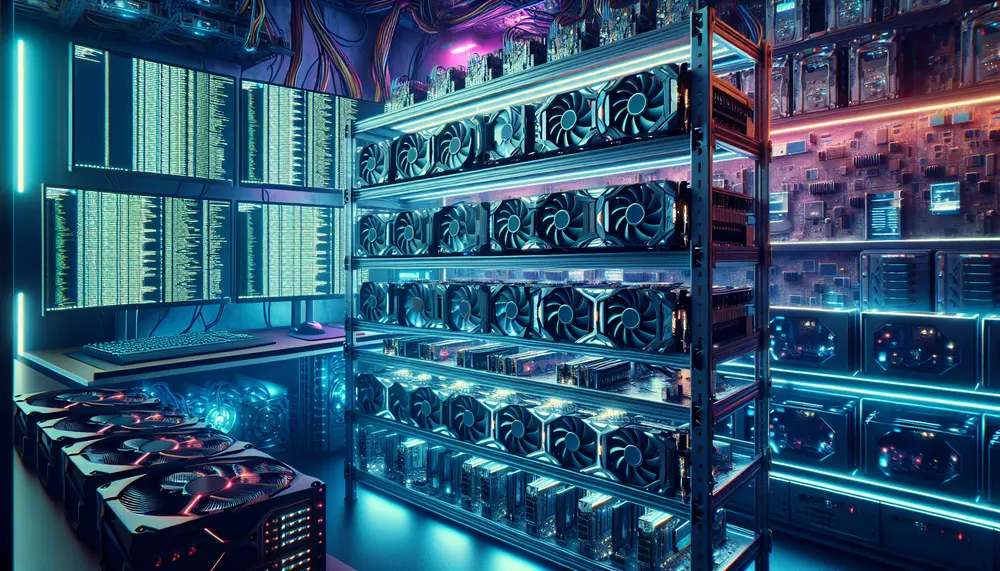

Investing in the latest hardware is crucial for maximizing the profitability of Siacoin mining. In 2023, several new and efficient mining devices have entered the market, making it easier for miners to achieve higher returns.

Here are some of the latest hardware options for Siacoin mining:

- iBeLink BM-S3: This ASIC miner is specifically designed for Siacoin mining. It offers a high hash rate and energy efficiency, making it one of the most profitable options available.

- Obelisk SC1: Another powerful ASIC miner, the Obelisk SC1, provides excellent performance and is optimized for the Blake2b algorithm used by Siacoin.

- Antminer A3: Although primarily designed for other cryptocurrencies, the Antminer A3 can also be configured for Siacoin mining, offering flexibility and high efficiency.

When choosing hardware, consider factors such as hash rate, power consumption, and initial cost. Using the latest and most efficient hardware can significantly improve your mining profitability.

Using GPUs for Siacoin Mining

While ASIC miners are often the go-to choice for Siacoin mining, GPUs can also be used effectively. GPUs offer flexibility and can be repurposed for mining other cryptocurrencies if needed. However, they may not be as efficient as ASIC miners for Siacoin.

Here are some considerations for using GPUs in Siacoin mining:

- Flexibility: GPUs can mine multiple cryptocurrencies, making them a versatile option if you plan to diversify your mining activities.

- Initial Cost: GPUs are generally less expensive than ASIC miners, making them a more accessible option for beginners.

- Hash Rate: While GPUs offer lower hash rates compared to ASIC miners, they can still be profitable, especially if you have access to low-cost electricity.

- Software: You'll need to use mining software compatible with GPUs, such as Sia-UI or CGMiner, to effectively mine Siacoin.

To maximize profitability, consider using a mining rig with multiple GPUs. This setup can increase your overall hash rate and improve your chances of earning more Siacoin. Additionally, keep an eye on the market prices and adjust your mining strategy as needed.

Evaluating ASIC Miners for Siacoin

ASIC miners are specialized hardware designed for mining specific cryptocurrencies, including Siacoin. Evaluating the right ASIC miner is crucial for maximizing the profitability of Siacoin mining. Here are some key factors to consider when evaluating ASIC miners for Siacoin:

- Hash Rate: The hash rate measures the processing power of the miner. A higher hash rate means the miner can solve more cryptographic puzzles, increasing your chances of earning Siacoin.

- Power Consumption: Efficient power usage is essential for profitability. Compare the power consumption (measured in watts) of different ASIC miners to find the most energy-efficient option.

- Initial Cost: The upfront cost of the ASIC miner can vary significantly. Consider your budget and calculate how long it will take to recoup your investment based on current Siacoin prices and mining difficulty.

- Durability and Reliability: Look for miners with a good track record of durability and reliability. Frequent breakdowns can lead to downtime and lost profits.

- Manufacturer Support: Choose ASIC miners from reputable manufacturers that offer good customer support and warranty options. This can be crucial if you encounter any issues with your hardware.

One of the most efficient ASIC miners for Siacoin is the iBeLink BM-S3. It offers a high hash rate and low power consumption, making it a popular choice among Siacoin miners. By carefully evaluating these factors, you can select the best ASIC miner to maximize your Siacoin mining profitability.

Profits: Short-term vs. Long-term Analysis

When evaluating the profitability of Siacoin mining, it's essential to consider both short-term and long-term perspectives. Each approach has its own set of advantages and challenges.

Short-term Analysis

Short-term analysis focuses on immediate returns and is influenced by current market conditions. Key factors include:

- Current Siacoin Price: The market price of Siacoin can fluctuate daily. Higher prices can lead to immediate profits.

- Network Difficulty: Changes in mining difficulty can impact your earnings. Lower difficulty means easier mining and higher short-term profits.

- Electricity Costs: Short-term profitability is heavily influenced by your electricity rates. Lower costs can result in higher immediate returns.

Short-term analysis is useful for making quick decisions and adapting to market changes. However, it can be volatile and less predictable.

Long-term Analysis

Long-term analysis takes a broader view, considering trends and potential future developments. Key factors include:

- Market Trends: Analyzing historical data and market trends can help predict future Siacoin prices and mining difficulty.

- Hardware Longevity: Investing in durable and efficient hardware can provide sustained profitability over time.

- Regulatory Changes: Keeping an eye on potential regulatory changes can help you prepare for long-term impacts on mining operations.

Long-term analysis helps in planning and making strategic investments. It considers the sustainability of mining operations and potential future profits.

By balancing both short-term and long-term analyses, you can develop a comprehensive strategy for maximizing your Siacoin mining profitability.

Tools to Estimate Siacoin Mining Profitability

Estimating the profitability of Siacoin mining can be complex, but several tools can help simplify the process. These tools use current data to provide accurate profitability estimates, helping you make informed decisions.

Here are some useful tools for estimating Siacoin mining profitability:

- Profitability Calculators: Online calculators like ASIC Miner Value and WhatToMine allow you to input your hardware specifications, electricity costs, and other variables to estimate potential earnings. These calculators are updated regularly with the latest data.

- Hashrate Converters: Tools like Hashrate Converter help you convert different units of hashrate, making it easier to compare the performance of various mining hardware.

- Mining Monitoring Software: Software like Minerstat and Hive OS provide real-time monitoring of your mining operations. They offer insights into hashrate, power consumption, and profitability, allowing you to optimize your setup.

- Market Data Platforms: Websites like CoinGecko and CoinMarketCap provide up-to-date market data, including Siacoin prices and trading volumes. This information is crucial for estimating potential profits.

Using these tools, you can get a comprehensive view of your mining profitability. Regularly updating your estimates and adjusting your strategy based on the latest data will help you maximize your Siacoin mining earnings.

Potential Risks in Siacoin Mining

While Siacoin mining can be profitable, it also comes with several potential risks. Understanding these risks can help you make informed decisions and mitigate potential losses.

Here are some of the key risks associated with Siacoin mining:

- Market Volatility: The price of Siacoin can fluctuate significantly. A sudden drop in price can make mining unprofitable, especially if you have high operational costs.

- Hardware Failures: Mining hardware can be prone to failures and breakdowns. Regular maintenance and investing in reliable equipment can help reduce this risk.

- Regulatory Changes: Government regulations on cryptocurrency mining can change, potentially impacting your operations. Stay informed about regulatory developments in your region.

- Increasing Difficulty: As more miners join the network, the difficulty of mining Siacoin increases. This can reduce your earnings over time, making it harder to remain profitable.

- Electricity Costs: Fluctuations in electricity prices can impact your profitability. High electricity costs can quickly eat into your earnings, especially during periods of low Siacoin prices.

- Network Security: While Siacoin's decentralized nature offers security benefits, the network is not immune to attacks. Potential security breaches can affect the overall stability and profitability of mining.

By being aware of these risks and taking proactive measures, you can better navigate the challenges of Siacoin mining. Regularly monitoring market conditions, maintaining your hardware, and staying updated on regulatory changes will help you mitigate these risks and maximize your mining profitability.

Conclusion

In conclusion, the profitability of Siacoin mining in 2023 depends on various factors, including hardware efficiency, electricity costs, market conditions, and regulatory environment. By understanding these elements and using the right tools, you can make informed decisions to maximize your mining returns.

Investing in the latest ASIC miners, monitoring market trends, and being aware of potential risks are crucial steps for achieving profitability. Whether you are a beginner or an experienced miner, staying updated with the latest developments and adjusting your strategy accordingly will help you navigate the complexities of Siacoin mining.

Ultimately, balancing short-term gains with long-term sustainability will provide a comprehensive approach to maximizing your Siacoin mining profitability. By leveraging the insights and tools discussed in this article, you can enhance your chances of success in the ever-evolving world of cryptocurrency mining.

FAQ on Siacoin Mining Profitability in 2023

What factors affect the profitability of Siacoin mining?

The profitability of Siacoin mining is influenced by several factors, including hardware costs, electricity costs, network difficulty, and the current market price of Siacoin. Efficient hardware and low electricity rates can significantly improve profitability.

Is investing in the latest hardware crucial for Siacoin mining profitability?

Yes, investing in the latest, most efficient hardware such as the iBeLink BM-S3 ASIC miner is crucial for maximizing profitability. Newer hardware typically offers higher hash rates and better energy efficiency, which can enhance mining returns.

Can GPUs be used for Siacoin mining, and are they profitable?

GPUs can be used for Siacoin mining, but they may not be as efficient as ASIC miners. They offer flexibility to mine different cryptocurrencies and are generally more accessible for beginners, though their profitability depends on electricity costs and hash rate.

What are the potential risks in Siacoin mining?

Siacoin mining involves risks such as market volatility, hardware failures, regulatory changes, increasing network difficulty, electricity cost fluctuations, and potential network security issues. Proper risk management and regular monitoring are essential to mitigate these risks.

What tools can help estimate the profitability of Siacoin mining?

Several tools can help estimate Siacoin mining profitability, including online profitability calculators like ASIC Miner Value and WhatToMine, hashrate converters, mining monitoring software such as Minerstat and Hive OS, and market data platforms like CoinGecko and CoinMarketCap.