Table of Contents:

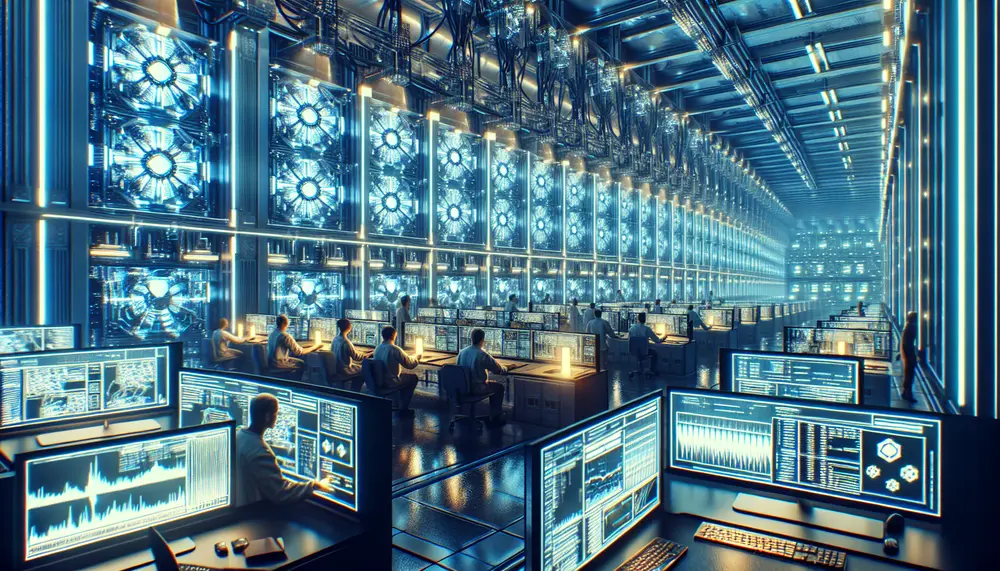

Introduction to Grin Mining

Grin is a relatively new cryptocurrency that has gained attention since its launch in 2018. It stands out due to its implementation of the Mimblewimble protocol, which focuses on privacy and scalability. As a result, many miners are curious about whether Grin mining is worth their time and investment in 2023.

This article aims to provide a comprehensive analysis of the costs and benefits associated with mining Grin. We will explore the necessary hardware, software, and energy costs, as well as potential returns. By the end of this article, you should have a clear understanding of whether Grin mining is a viable option for you this year.

Get $500 free Bitcoin mining for a free testing phase:

- Real daily rewards

- 1 full month of testing

- No strings attached

If you choose to buy after testing, you can keep your mining rewards and receive up to 20% bonus on top.

The Basics of Grin (GRIN)

Grin (GRIN) is a privacy-focused cryptocurrency that uses the Mimblewimble protocol. This protocol ensures that transactions are both private and scalable. Unlike many other cryptocurrencies, Grin does not have a fixed supply limit. Instead, it has a linear emission rate, which means that new coins are continuously created at a steady pace.

Here are some key features of Grin:

- Privacy: Grin transactions are confidential, hiding the amounts being transferred.

- Scalability: The Mimblewimble protocol reduces blockchain bloat, making Grin more scalable.

- Decentralization: Grin aims to remain decentralized, with no central authority controlling the network.

- Community-driven: Grin is developed and maintained by a community of volunteers and funded through donations.

Understanding these basics is crucial for anyone considering mining Grin. It helps you appreciate the unique aspects of this cryptocurrency and why it might be worth mining in 2023.

Current Market Overview

Before diving into the specifics of mining Grin, it's essential to understand the current market conditions. As of 2023, Grin's market price has shown some volatility, reflecting broader trends in the cryptocurrency market. However, it remains a popular choice among privacy-focused coins.

Here are some key points about the current market for Grin:

- Market Price: The price of Grin fluctuates, influenced by market demand and overall crypto trends.

- Market Capitalization: Grin's market cap is relatively modest compared to giants like Bitcoin and Ethereum, but it has a dedicated user base.

- Trading Volume: Grin sees consistent trading activity on various exchanges, indicating ongoing interest from traders and investors.

- Adoption: While not as widely adopted as some other cryptocurrencies, Grin has carved out a niche among privacy advocates.

Understanding the market dynamics is crucial for assessing the potential profitability of mining Grin. It helps you gauge the demand for the coin and its potential future value.

Required Mining Hardware for Grin

To mine Grin effectively, you need the right hardware. The choice of hardware can significantly impact your mining efficiency and profitability. Here, we will discuss the essential hardware required for Grin mining.

Grin can be mined using both GPUs (Graphics Processing Units) and ASICs (Application-Specific Integrated Circuits). Each has its advantages and disadvantages.

GPUs:

- AMD RX 6900 XT: Known for its high performance and efficiency, this GPU is a popular choice among Grin miners.

- Nvidia RTX 3090: Another powerful option, the RTX 3090 offers excellent hash rates and energy efficiency.

ASICs:

- Innosilicon G32-1800: This ASIC miner is specifically designed for Grin mining and offers high hash rates and efficiency.

- iPollo G1: Another specialized ASIC miner, the iPollo G1, provides robust performance for Grin mining.

Choosing the right hardware depends on your budget, energy costs, and mining goals. GPUs offer flexibility and can be used for other tasks, while ASICs are optimized for mining and provide higher efficiency.

Comparing GPUs and ASICs for Grin Mining

When deciding between GPUs and ASICs for Grin mining, it's important to understand the strengths and weaknesses of each. Both types of hardware have their own advantages, and the best choice depends on your specific needs and circumstances.

GPUs:

- Flexibility: GPUs can be used for a variety of tasks beyond mining, such as gaming or graphic design.

- Initial Cost: Generally, GPUs have a lower upfront cost compared to ASICs.

- Availability: GPUs are widely available and can be easily purchased from various retailers.

- Hash Rate: While powerful, GPUs typically offer lower hash rates compared to ASICs.

ASICs:

- Efficiency: ASICs are specifically designed for mining and offer higher efficiency and hash rates.

- Profitability: Due to their optimized performance, ASICs can be more profitable in the long run.

- Specialization: ASICs are built for a single purpose, which means they can't be repurposed for other tasks.

- Initial Cost: ASICs usually have a higher upfront cost, which can be a barrier for some miners.

In summary, GPUs offer flexibility and lower initial costs, making them suitable for beginners or those with multiple use cases. On the other hand, ASICs provide higher efficiency and profitability, ideal for dedicated miners focused solely on Grin mining.

Software and Operating Systems for Grin Mining

Choosing the right software and operating system is crucial for efficient Grin mining. The software you use can affect your mining performance, ease of management, and overall profitability. Here, we will discuss some popular options for both GPUs and ASICs.

For GPUs:

- Minerstat: A Linux-based mining OS that offers a range of features including overclocking tools, smart profit switch, heatmap visualization, real-time analytics, diagnostic tools, automated health checks, and alerts.

- Windows: Many miners use Windows for its ease of use and compatibility with various mining software. Popular choices include CGMiner and Bminer.

For ASICs:

- ASIC Hub: This software is designed for monitoring and managing large ASIC brands like Antminer, Avalon, Whatsminer, and Innosilicon. It provides a centralized platform for managing multiple devices.

Each of these software options has its own set of features and benefits. Minerstat is highly recommended for those who want a comprehensive solution with advanced tools. Windows-based software is suitable for those who prefer a familiar interface. ASIC Hub is ideal for managing large-scale ASIC operations.

Choosing the right software and operating system can significantly impact your mining efficiency and ease of management. Consider your specific needs and preferences when making your choice.

Energy Costs and Profitability

Energy costs are a critical factor in determining the profitability of Grin mining. The amount of electricity consumed by your mining hardware can significantly impact your overall earnings. Therefore, understanding and managing energy costs is essential for any miner.

Here are some key points to consider:

- Electricity Rates: The cost of electricity varies by location. Lower rates can make mining more profitable. For example, the Innosilicon G32-1800 is profitable if your electricity cost is below $0.403 per kWh, while the AMD RX 6900 XT is profitable below $0.039 per kWh.

- Power Consumption: Different hardware consumes different amounts of power. ASICs like the Innosilicon G32-1800 are more efficient but consume more power compared to GPUs like the AMD RX 6900 XT.

- Efficiency: Higher efficiency means more hash power per watt of electricity consumed. This is crucial for maximizing profitability.

To calculate profitability, you can use the following formula:

Profit = (Revenue from mined Grin) − (Electricity cost · Power consumption)

For example, if you mine 1 GRIN in an hour with an Innosilicon G32-1800, and the electricity cost is $0.10 per kWh, you can calculate the profit by subtracting the electricity cost from the revenue generated by the mined Grin.

Managing energy costs effectively can make a significant difference in your mining profitability. Consider using energy-efficient hardware and mining during off-peak hours when electricity rates are lower.

Breaking Down the Costs of Grin Mining

Understanding the costs involved in Grin mining is essential for evaluating its profitability. These costs can be divided into several categories, each contributing to the overall expense of your mining operation.

Initial Hardware Costs:

- GPUs: High-performance GPUs like the AMD RX 6900 XT and Nvidia RTX 3090 can be expensive, with prices ranging from $1,000 to $2,000.

- ASICs: Specialized ASIC miners such as the Innosilicon G32-1800 and iPollo G1 are more costly, often exceeding $5,000.

Electricity Costs:

- Power Consumption: The amount of electricity your hardware consumes is a significant factor. For example, the Innosilicon G32-1800 consumes around 1,800 watts, while the AMD RX 6900 XT consumes approximately 300 watts.

- Electricity Rates: The cost per kilowatt-hour (kWh) varies by location. Lower rates can make mining more profitable.

Maintenance Costs:

- Cooling: Effective cooling solutions are necessary to prevent overheating, which can incur additional costs.

- Repairs and Replacements: Hardware can fail, requiring repairs or replacements, adding to the overall cost.

Software and Management Costs:

- Mining Software: Some mining software may have subscription fees or one-time purchase costs.

- Management Tools: Tools like Minerstat or ASIC Hub may also have associated costs for advanced features.

To break down the costs mathematically, consider the following formula:

Total Cost = Initial Hardware Cost + (Electricity Cost · Power Consumption · Hours of Operation) + Maintenance Costs + Software Costs

For example, if you use an Innosilicon G32-1800 with an initial cost of $5,000, an electricity rate of $0.10 per kWh, and it operates for 24 hours a day, the daily electricity cost would be:

Daily Electricity Cost = 1,800 watts · 24 hours · $0.10 per kWh = $4.32

Breaking down these costs helps you understand the financial commitment required for Grin mining and allows you to calculate potential profitability more accurately.

Potential Returns on Grin Mining

Calculating the potential returns on Grin mining involves understanding both the revenue generated and the costs incurred. Here, we will break down the factors that influence your potential earnings from mining Grin.

Revenue from Mined Grin:

- Hash Rate: The higher your hash rate, the more Grin you can mine. For example, the Innosilicon G32-1800 has a high hash rate, allowing you to mine more coins compared to a GPU like the AMD RX 6900 XT.

- Grin Price: The market price of Grin fluctuates. Higher prices increase your potential returns, while lower prices decrease them.

- Mining Difficulty: As more miners join the network, the difficulty increases, making it harder to mine Grin. This can affect your overall returns.

Calculating Potential Returns:

To estimate your potential returns, you can use the following formula:

Potential Returns = (Mined Grin · Grin Price) − Total Costs

For example, if you mine 10 GRIN in a month and the current price of Grin is $2 per coin, your revenue would be:

Revenue = 10 GRIN · $2 = $20

Next, subtract your total costs, which include electricity, hardware depreciation, and maintenance:

Total Costs = Electricity Cost + Hardware Depreciation + Maintenance

If your total costs for the month are $15, your potential returns would be:

Potential Returns = $20 − $15 = $5

By understanding these factors and using this formula, you can estimate your potential returns from Grin mining. Keep in mind that market conditions and mining difficulty can change, so it's essential to stay updated and adjust your calculations accordingly.

Challenges and Risks in Grin Mining

While Grin mining can be profitable, it also comes with its own set of challenges and risks. Understanding these can help you make informed decisions and better prepare for potential obstacles.

Volatility of Grin Price:

- The price of Grin can fluctuate significantly. This volatility can impact your potential returns and make it difficult to predict long-term profitability.

Increasing Mining Difficulty:

- As more miners join the network, the mining difficulty increases. This means you need more computational power to mine the same amount of Grin, which can reduce your profitability.

Hardware Failure:

- Mining hardware can fail or become obsolete. Repairs and replacements can be costly and disrupt your mining operations.

Energy Costs:

- High electricity costs can eat into your profits. Fluctuating energy prices can also make it challenging to maintain consistent profitability.

Regulatory Risks:

- Cryptocurrency regulations vary by country and can change over time. New regulations could impact your ability to mine Grin or affect its market value.

Network Security:

- While Grin uses the Mimblewimble protocol for enhanced privacy, no system is entirely immune to attacks. Network security issues could impact the value and trust in Grin.

By being aware of these challenges and risks, you can take steps to mitigate them. Diversifying your mining portfolio, staying updated on market trends, and investing in reliable hardware can help you navigate the complexities of Grin mining.

Expert Opinions on Grin Mining

Expert opinions on Grin mining can provide valuable insights and help you make informed decisions. Here, we summarize some key perspectives from industry experts on the viability and future of Grin mining.

Positive Outlook:

- Many experts appreciate Grin's focus on privacy and scalability. They believe that these features make Grin a unique and valuable cryptocurrency in the long term.

- Some industry analysts highlight the community-driven development of Grin, which they see as a strength. They argue that a dedicated community can drive innovation and ensure the project's sustainability.

Concerns and Challenges:

- Experts also point out the challenges associated with Grin's linear emission rate. Unlike Bitcoin, which has a capped supply, Grin's continuous creation of new coins could lead to inflationary pressures.

- There are concerns about the increasing mining difficulty and the need for specialized hardware. Some experts caution that this could make Grin mining less accessible to individual miners.

Market Potential:

- Some analysts believe that Grin has significant market potential due to its privacy features. They argue that as privacy concerns grow, more users may turn to privacy-focused cryptocurrencies like Grin.

- Others are more cautious, noting that Grin's market adoption is still limited compared to more established cryptocurrencies. They suggest that broader adoption is necessary for Grin to achieve its full potential.

Overall, expert opinions on Grin mining are mixed. While there is optimism about its unique features and community support, there are also concerns about its economic model and accessibility. By considering these expert insights, you can better evaluate whether Grin mining aligns with your goals and risk tolerance.

Conclusion: Is Grin Worth Mining in 2023?

After analyzing various aspects of Grin mining, the question remains: Is Grin worth mining in 2023? The answer depends on several factors, including your hardware, electricity costs, and risk tolerance.

Grin offers unique advantages such as privacy and scalability, making it an attractive option for miners interested in these features. The community-driven development and the Mimblewimble protocol add to its appeal. However, there are also challenges, such as the increasing mining difficulty, hardware costs, and the volatility of Grin's market price.

Here are some key takeaways:

- Hardware Choice: Investing in efficient hardware like the Innosilicon G32-1800 or high-performance GPUs can improve your mining efficiency and profitability.

- Electricity Costs: Managing energy costs is crucial. Lower electricity rates can significantly enhance your returns.

- Market Conditions: Stay updated on Grin's market price and mining difficulty. These factors can influence your potential returns.

- Risk Management: Be aware of the risks, including hardware failure, regulatory changes, and market volatility. Diversifying your mining portfolio can help mitigate some of these risks.

In conclusion, Grin mining can be worth it in 2023 if you have the right setup and are prepared to manage the associated risks. Conduct thorough research, stay informed about market trends, and carefully calculate your potential returns before making a decision. By doing so, you can make an informed choice about whether Grin mining aligns with your goals and investment strategy.

Frequently Asked Questions about Grin Mining in 2023

What is Grin, and how does it differ from other cryptocurrencies?

Grin is a privacy-focused cryptocurrency that uses the Mimblewimble protocol to keep transactions confidential and scalable. Unlike many other cryptocurrencies, Grin does not have a fixed supply limit and has a linear emission rate.

What hardware is required for mining Grin?

Grin can be mined using both GPUs and ASICs. Popular GPUs include the AMD RX 6900 XT and Nvidia RTX 3090, while efficient ASICs include the Innosilicon G32-1800 and iPollo G1.

Is it more profitable to mine Grin using GPUs or ASICs?

ASICs are generally more efficient and profitable due to their higher hash rates and optimized performance for mining. GPUs, however, offer greater flexibility and have lower initial costs.

What are the energy costs associated with mining Grin?

Energy costs are a crucial factor in mining profitability. The Innosilicon G32-1800 is profitable with electricity costs below $0.403 per kWh, while the AMD RX 6900 XT is profitable below $0.039 per kWh. The power consumption of your hardware also impacts overall costs.

What are the risks involved in Grin mining?

Grin mining involves several risks, including volatility in Grin's price, increasing mining difficulty, potential hardware failures, high energy costs, regulatory changes, and network security issues. Understanding and managing these risks is crucial for a successful mining operation.