Table of Contents:

Introduction to Crypto Mining in 2024

As we step into 2024, the landscape of crypto mining continues to evolve. With advancements in technology and fluctuating market conditions, understanding the basics of mining is crucial. Crypto mining involves solving complex mathematical problems to validate transactions on the blockchain. Successful miners receive cryptocurrency as a reward, making it a potentially lucrative venture.

However, the question remains: is crypto mining profitable in 2024? The answer depends on several factors, including the cost of equipment, electricity prices, and the current value of cryptocurrencies. As these elements change, so does the potential for profit.

Get $500 free Bitcoin mining for a free testing phase:

- Real daily rewards

- 1 full month of testing

- No strings attached

If you choose to buy after testing, you can keep your mining rewards and receive up to 20% bonus on top.

In 2024, miners must stay informed about industry trends and technological innovations. This knowledge helps them make informed decisions about their mining operations. As we delve deeper into this topic, we'll explore the various factors that influence mining profitability and how miners can optimize their strategies for success.

Factors Impacting Crypto Mining Profitability

Several key factors determine whether crypto mining is profitable in 2024. Understanding these elements can help miners maximize their returns and make informed decisions.

- Hardware Efficiency: The type of mining equipment used plays a crucial role. Advanced ASICs (Application-Specific Integrated Circuits) offer higher efficiency and better performance compared to older models. Choosing the right hardware can significantly impact your mining success.

- Electricity Costs: The cost of electricity is a major expense for miners. Regions with lower electricity rates can offer a competitive advantage. Miners should calculate their energy consumption and find ways to reduce costs to enhance profitability.

- Mining Difficulty: As more miners join the network, the difficulty of mining increases. This means it takes more computational power to solve problems and earn rewards. Staying updated on difficulty levels is essential for planning your mining strategy.

- Market Value of Cryptocurrency: The price of the cryptocurrency being mined directly affects profitability. A higher market value means greater potential earnings. Miners should monitor market trends and adjust their operations accordingly.

- Regulatory Environment: Changes in regulations can impact mining operations. Understanding local laws and potential restrictions is important for long-term planning and compliance.

By considering these factors, miners can better assess their potential for profit and adapt their strategies to the ever-changing crypto landscape.

The Role of Technology in Mining Profitability

In 2024, technology continues to be a driving force behind crypto mining profitability. As the industry evolves, miners must leverage the latest technological advancements to stay competitive and maximize their earnings.

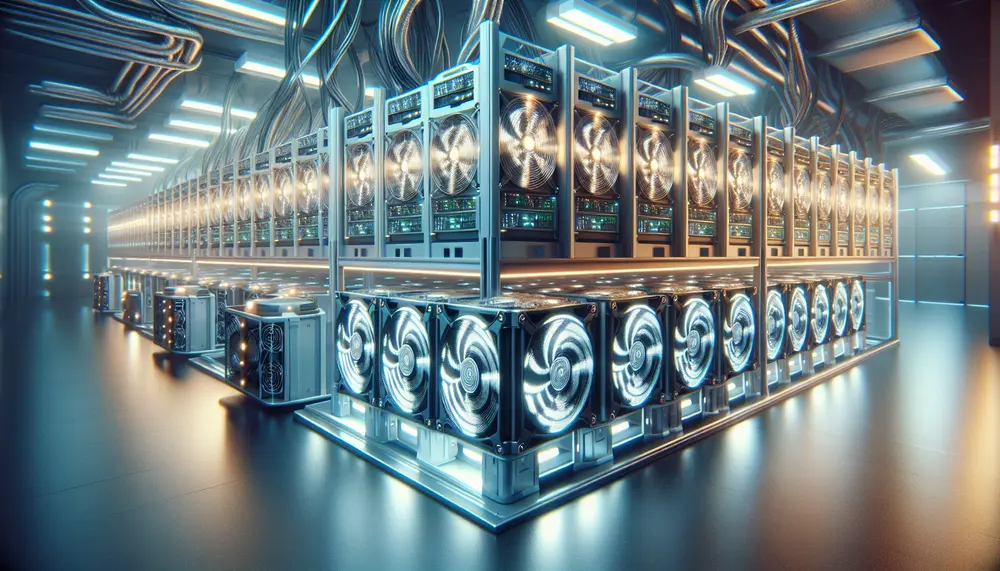

One of the most significant technological factors is the development of more efficient mining hardware. Modern ASICs are designed to perform mining tasks faster and with less energy consumption. This efficiency reduces operational costs and increases the likelihood of earning rewards.

Additionally, software improvements play a crucial role. Enhanced mining software can optimize hardware performance, manage power usage, and provide real-time data analytics. These tools help miners make informed decisions and adjust their strategies as needed.

Another technological aspect is the use of advanced cooling systems. As mining hardware generates significant heat, effective cooling solutions are essential to maintain performance and prevent damage. Innovative cooling technologies can extend the lifespan of equipment and reduce maintenance costs.

Finally, blockchain technology itself is evolving. New consensus algorithms and network upgrades can impact mining processes. Staying informed about these changes allows miners to adapt and potentially gain an edge over competitors.

By embracing technological advancements, miners can enhance their operations and improve their chances of achieving profitability in the dynamic world of crypto mining.

Electricity Costs and Their Effect on Earnings

Electricity costs are a major factor affecting crypto mining profitability. In 2024, the price of electricity can significantly influence a miner's earnings. Understanding and managing these costs is crucial for maintaining a profitable operation.

Miners consume a large amount of electricity to power their hardware. This energy usage translates directly into operational expenses. Regions with lower electricity rates offer a distinct advantage, allowing miners to reduce their costs and increase their net earnings.

To manage electricity expenses, miners can consider several strategies:

- Location Selection: Choosing a location with affordable electricity rates can make a substantial difference. Some miners relocate their operations to areas with cheaper energy to maximize profits.

- Energy Efficiency: Using energy-efficient hardware and optimizing power usage can lower electricity consumption. Implementing power-saving measures can help reduce costs without sacrificing performance.

- Renewable Energy: Some miners invest in renewable energy sources, such as solar or wind power. These options can provide a sustainable and cost-effective solution for powering mining operations.

By carefully managing electricity costs, miners can improve their overall profitability and sustain their operations in the competitive world of crypto mining.

Market Value of Bitcoin and Its Influence

The market value of Bitcoin plays a pivotal role in determining the profitability of crypto mining. As the price of Bitcoin fluctuates, so does the potential for earnings. In 2024, understanding these dynamics is essential for miners aiming to maximize their returns.

When the market value of Bitcoin is high, miners can earn more from their efforts. The rewards they receive in Bitcoin translate into greater monetary value, enhancing profitability. Conversely, a decline in Bitcoin's price can reduce earnings, making it harder to cover operational costs.

Several factors influence Bitcoin's market value:

- Market Demand: Increased demand for Bitcoin can drive up its price. Factors such as adoption by institutions and retail investors can contribute to this demand.

- Regulatory News: Announcements regarding cryptocurrency regulations can impact market sentiment and Bitcoin's value. Positive news may boost prices, while negative news can cause declines.

- Global Economic Conditions: Economic factors, such as inflation and currency fluctuations, can affect Bitcoin's appeal as a store of value, influencing its market price.

Miners must stay informed about these factors and market trends. By doing so, they can make strategic decisions about when to mine and when to hold or sell their Bitcoin, optimizing their profitability in the ever-changing crypto landscape.

Mining Pools: Boosting Your Profits

Joining a mining pool can be a strategic move to enhance your crypto mining profitability in 2024. Mining pools allow individual miners to combine their computational power, increasing their chances of successfully mining a block and earning rewards.

When miners work together in a pool, they share the rewards based on their contributed processing power. This collaboration reduces the variance in earnings, providing a more stable and predictable income stream. For many miners, especially those with limited resources, this stability is crucial.

Here are some benefits of participating in a mining pool:

- Increased Success Rate: By pooling resources, miners can tackle more complex problems, increasing the likelihood of solving a block and receiving rewards.

- Steady Income: Pools distribute earnings among members, offering more consistent payouts compared to solo mining, where income can be sporadic.

- Lower Entry Barrier: New miners can join pools without needing extensive resources, making it easier to participate in the mining process.

While mining pools offer many advantages, it's important to choose a reputable pool with fair distribution policies and low fees. By carefully selecting the right pool, miners can maximize their profits and achieve greater success in the competitive world of crypto mining.

Conducting a Cost-Benefit Analysis

Conducting a cost-benefit analysis is essential for determining the potential profitability of crypto mining in 2024. This analysis helps miners evaluate whether their investment in mining operations will yield positive returns.

To perform a cost-benefit analysis, consider the following steps:

- Calculate Initial Costs: Assess the expenses involved in setting up a mining operation. This includes the cost of hardware, setup fees, and any additional infrastructure needed.

- Estimate Operational Costs: Determine ongoing expenses such as electricity, maintenance, and cooling. These costs can vary based on location and equipment efficiency.

- Project Revenue: Estimate potential earnings based on current cryptocurrency prices and mining difficulty. Consider the rewards from mining pools if applicable.

- Analyze Break-Even Point: Calculate the time it will take to recover initial and operational costs. This helps assess the viability of the mining venture.

- Consider Risks and Variables: Account for factors such as market volatility, regulatory changes, and technological advancements that could impact profitability.

By systematically evaluating these components, miners can make informed decisions about their mining activities. A thorough cost-benefit analysis provides a clear picture of potential returns and helps identify areas for optimization, ensuring a more strategic approach to crypto mining.

Current Discussions: Insights from Reddit

Reddit remains a vibrant platform for discussions about crypto mining profitability. In 2024, miners and enthusiasts share insights, experiences, and strategies, providing valuable perspectives for both newcomers and seasoned miners.

Some key topics often discussed on Reddit include:

- Personal Experiences: Miners share their success stories and challenges, offering real-world insights into the profitability of mining under different conditions.

- Hardware Recommendations: Users discuss the latest mining equipment, comparing performance and efficiency to help others make informed purchasing decisions.

- Cost-Saving Tips: Community members exchange advice on reducing operational costs, such as optimizing energy consumption and selecting cost-effective locations.

- Market Trends: Discussions about cryptocurrency market trends and price predictions help miners anticipate changes that could affect their earnings.

Engaging with these discussions can provide miners with a broader understanding of the current mining landscape. By tapping into the collective knowledge of the Reddit community, miners can gain insights that might not be readily available through other sources, enhancing their strategies and decision-making processes.

Conclusion: Is Crypto Mining a Worthwhile Pursuit in 2024?

As we conclude our exploration of crypto mining profitability in 2024, it's clear that the decision to pursue mining depends on various factors. While mining can still be profitable, it requires careful planning and strategic execution.

Miners must consider the cost of equipment, electricity expenses, and the ever-changing market value of cryptocurrencies. Additionally, technological advancements and participation in mining pools can significantly impact potential earnings.

For those willing to invest time and resources into understanding these dynamics, crypto mining can offer rewarding opportunities. However, it's essential to conduct thorough research and remain adaptable to industry changes.

Ultimately, whether crypto mining is a worthwhile pursuit in 2024 depends on individual circumstances and the ability to navigate the complexities of the mining landscape. By staying informed and making strategic decisions, miners can position themselves for success in this competitive field.

Understanding Crypto Mining Profitability in 2024

What factors influence crypto mining profitability in 2024?

Key factors include hardware efficiency, electricity costs, mining difficulty, the market value of the cryptocurrency, and regulatory environment.

How does the type of hardware affect mining success?

Advanced ASICs offer higher efficiency and better performance compared to older models, significantly impacting mining success.

Why are electricity costs significant for miners?

Electricity costs are a major expense since mining hardware consumes large amounts of energy. Lower rates can reduce these costs and improve profitability.

What role do mining pools play in boosting profits?

Mining pools allow miners to combine computational power, increasing the chances of earning rewards and providing a more stable income stream.

How can a cost-benefit analysis aid in deciding to mine crypto?

It helps assess initial and operational costs versus projected revenue, allowing miners to determine the viability and potential profitability of their mining operations.