Table of Contents:

Introduction to Ethereum Mining Stocks

Investing in Ethereum mining stocks can be a lucrative opportunity for those interested in the cryptocurrency market. Ethereum, the second-largest cryptocurrency by market capitalization, relies on a decentralized network of miners to validate transactions and secure the network. These miners use powerful hardware to solve complex mathematical problems, earning rewards in the form of newly minted Ethereum.

As the popularity of Ethereum continues to grow, so does the interest in companies that are involved in its mining process. By investing in these companies, you can gain exposure to the potential profits from Ethereum mining without the need to purchase and maintain expensive mining equipment yourself.

Get $500 free Bitcoin mining for a free testing phase:

- Real daily rewards

- 1 full month of testing

- No strings attached

If you choose to buy after testing, you can keep your mining rewards and receive up to 20% bonus on top.

This article will guide you through everything you need to know about Ethereum mining stocks, from understanding what they are to evaluating their potential as an investment. Whether you're a seasoned investor or a beginner, this comprehensive guide will provide valuable insights to help you make informed decisions.

What Are Ethereum Mining Stocks?

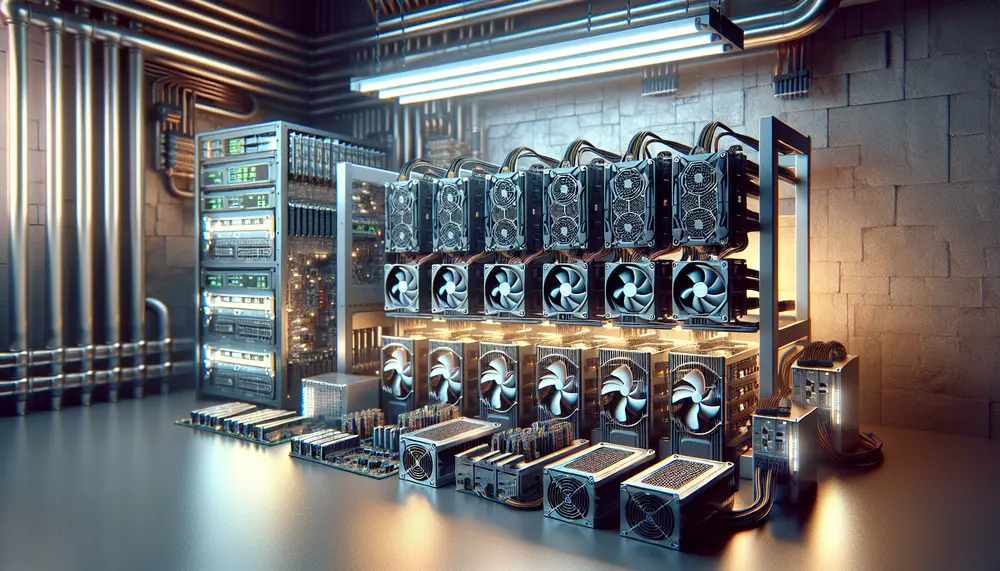

Ethereum mining stocks represent shares in publicly traded companies that are involved in the mining of Ethereum. These companies invest in specialized hardware and software to mine Ethereum, which involves validating transactions on the Ethereum blockchain and earning rewards in the form of newly created Ethereum tokens.

By purchasing shares in these companies, investors can gain indirect exposure to the Ethereum mining process. This means that instead of buying and managing mining equipment themselves, investors can benefit from the expertise and resources of established mining firms. This can be a more convenient and less risky way to participate in the Ethereum mining ecosystem.

Ethereum mining stocks can be found on various stock exchanges, and their performance is often tied to the price of Ethereum and the overall health of the cryptocurrency market. These stocks can offer a way to diversify an investment portfolio and potentially profit from the growth of Ethereum without directly holding the cryptocurrency.

It's important to note that the value of Ethereum mining stocks can be influenced by several factors, including the price of Ethereum, mining difficulty, electricity costs, and regulatory changes. Therefore, investors should conduct thorough research and consider these variables before investing.

Key Companies in Ethereum Mining

Several key companies have established themselves as major players in the Ethereum mining industry. These companies have invested heavily in mining infrastructure and technology to efficiently mine Ethereum and generate profits. Here are some of the notable companies involved in Ethereum mining:

- HIVE Blockchain Technologies: HIVE is a well-known name in the cryptocurrency mining space. They operate large-scale mining facilities in Canada, Sweden, and Iceland. Although they have diversified their operations to include other cryptocurrencies, Ethereum mining remains a significant part of their business.

- Riot Blockchain: While primarily focused on Bitcoin mining, Riot Blockchain has also ventured into Ethereum mining. They have expanded their mining operations to include state-of-the-art facilities that can mine multiple cryptocurrencies, including Ethereum.

- Marathon Digital Holdings: Marathon is another major player in the cryptocurrency mining industry. Although their primary focus is on Bitcoin, they have shown interest in Ethereum mining and have the capability to adapt their operations to mine Ethereum if market conditions are favorable.

- Bitfarms: Bitfarms operates several mining farms across North America. They have a diversified portfolio that includes both Bitcoin and Ethereum mining. Their efficient operations and strategic locations help them to remain competitive in the mining industry.

These companies are publicly traded and offer investors a way to gain exposure to the Ethereum mining industry. By investing in these firms, you can benefit from their expertise, infrastructure, and economies of scale, which can be challenging to achieve as an individual miner.

How to Evaluate Ethereum Mining Stocks

Evaluating Ethereum mining stocks requires a careful analysis of several key factors. Understanding these factors can help you make informed investment decisions and identify the most promising opportunities in the market. Here are some essential criteria to consider:

- Financial Health: Examine the company's financial statements, including their balance sheet, income statement, and cash flow statement. Look for strong revenue growth, profitability, and healthy cash reserves. Companies with solid financial health are better positioned to weather market fluctuations.

- Mining Efficiency: Assess the company's mining efficiency by looking at their hash rate and energy consumption. A higher hash rate indicates more mining power, while lower energy consumption means reduced operational costs. Efficient miners are more likely to be profitable.

- Geographic Location: Consider the location of the company's mining operations. Regions with low electricity costs and favorable regulatory environments can significantly impact profitability. Companies operating in such areas have a competitive advantage.

- Technology and Innovation: Evaluate the company's investment in advanced mining technology and innovation. Companies that continuously upgrade their hardware and adopt new technologies are more likely to maintain a competitive edge in the rapidly evolving mining industry.

- Management Team: Research the experience and track record of the company's management team. Strong leadership with a proven history in the cryptocurrency and technology sectors can drive the company's success and navigate challenges effectively.

- Market Position: Analyze the company's market position and reputation within the industry. Leading companies with a strong market presence and positive reputation are more likely to attract investors and partners, enhancing their growth prospects.

By considering these factors, you can better evaluate the potential of Ethereum mining stocks and make more informed investment decisions. Remember to conduct thorough research and stay updated on industry trends to maximize your investment's success.

Risks and Rewards of Investing in Ethereum Mining Stocks

Investing in Ethereum mining stocks comes with its own set of risks and rewards. Understanding these can help you make a balanced decision and manage your investment portfolio effectively.

Rewards

- Potential for High Returns: As Ethereum's value increases, companies involved in mining can see significant profit growth. This can translate into higher stock prices and substantial returns for investors.

- Exposure to Cryptocurrency Market: Investing in Ethereum mining stocks provides indirect exposure to the cryptocurrency market. This can be a safer way to benefit from the growth of Ethereum without directly holding the cryptocurrency.

- Diversification: Adding Ethereum mining stocks to your portfolio can diversify your investments. This can reduce risk by spreading your investments across different asset classes.

Risks

- Market Volatility: The cryptocurrency market is highly volatile. Fluctuations in Ethereum's price can significantly impact the profitability of mining companies and, consequently, their stock prices.

- Regulatory Risks: Changes in regulations can affect the operations of mining companies. For example, stricter environmental regulations or bans on cryptocurrency mining can negatively impact these businesses.

- Technological Changes: The mining industry is technology-driven. Rapid advancements can render existing mining equipment obsolete, requiring companies to invest heavily in new technology to stay competitive.

- Operational Costs: High electricity costs and other operational expenses can eat into the profits of mining companies. Companies operating in regions with high energy costs may face profitability challenges.

While the potential rewards of investing in Ethereum mining stocks can be attractive, it's crucial to weigh these against the inherent risks. Conduct thorough research and consider your risk tolerance before making any investment decisions.

Market Trends for Ethereum Mining Stocks

The market for Ethereum mining stocks is influenced by several key trends. Understanding these trends can help investors make informed decisions and anticipate future market movements.

- Rising Ethereum Prices: As the price of Ethereum increases, the profitability of mining operations also rises. This can lead to higher stock prices for companies involved in Ethereum mining. Investors should keep an eye on Ethereum's market performance to gauge potential returns.

- Shift to Proof of Stake (PoS): Ethereum is transitioning from a Proof of Work (PoW) to a Proof of Stake (PoS) consensus mechanism. This shift, known as Ethereum 2.0, will reduce the need for traditional mining. Companies may need to adapt their business models to remain relevant.

- Increased Institutional Interest: Institutional investors are showing growing interest in cryptocurrencies, including Ethereum. This can lead to increased investment in Ethereum mining stocks, driving up their value. Companies that attract institutional investment may see significant growth.

- Environmental Concerns: The environmental impact of cryptocurrency mining is under scrutiny. Companies that adopt sustainable practices and use renewable energy sources may gain a competitive edge. Investors should consider the environmental policies of mining companies.

- Technological Advancements: Continuous improvements in mining technology can enhance efficiency and reduce costs. Companies that invest in cutting-edge technology are likely to perform better. Staying updated on technological trends is crucial for evaluating mining stocks.

These market trends play a significant role in shaping the landscape for Ethereum mining stocks. By staying informed about these trends, investors can better navigate the market and identify promising investment opportunities.

How to Start Investing in Ethereum Mining Stocks

Starting to invest in Ethereum mining stocks can be a straightforward process if you follow these steps. Here’s a guide to help you get started:

- Research and Identify Companies: Begin by researching companies involved in Ethereum mining. Look for publicly traded firms with a strong track record and positive market reputation. Evaluate their financial health, mining efficiency, and management team.

- Open a Brokerage Account: To buy stocks, you need a brokerage account. Choose a reputable brokerage platform that offers access to a wide range of stocks, including those in the cryptocurrency mining sector. Ensure the platform has low fees and user-friendly features.

- Fund Your Account: Once your brokerage account is set up, deposit funds into it. Most platforms offer various funding options, such as bank transfers, credit cards, or electronic wallets. Ensure you have enough funds to cover your planned investments.

- Place Your Order: After funding your account, search for the Ethereum mining stocks you’ve identified. Enter the stock ticker symbol and specify the number of shares you want to purchase. You can place a market order to buy at the current price or a limit order to buy at a specific price.

- Monitor Your Investment: After purchasing the stocks, regularly monitor their performance. Keep an eye on market trends, company news, and Ethereum price movements. This will help you make informed decisions about holding, selling, or buying more shares.

- Diversify Your Portfolio: To mitigate risk, consider diversifying your investments. Don’t put all your funds into a single stock. Spread your investments across different sectors and asset classes to create a balanced portfolio.

By following these steps, you can start investing in Ethereum mining stocks and potentially benefit from the growth of the cryptocurrency market. Remember to conduct thorough research and stay informed about industry developments to make the most of your investments.

Frequently Asked Questions About Ethereum Mining Stocks

Investing in Ethereum mining stocks can raise several questions, especially for beginners. Here are some frequently asked questions and their answers to help you better understand this investment option:

What are Ethereum mining stocks?

Ethereum mining stocks are shares in publicly traded companies that mine Ethereum. These companies use specialized hardware to validate transactions on the Ethereum blockchain and earn rewards in the form of newly created Ethereum tokens.

How do I buy Ethereum mining stocks?

To buy Ethereum mining stocks, you need to open a brokerage account, fund it, and place an order for the stocks you want to purchase. Research and identify reputable companies involved in Ethereum mining before making your investment.

What are the risks of investing in Ethereum mining stocks?

Risks include market volatility, regulatory changes, technological advancements, and high operational costs. The value of these stocks can fluctuate significantly based on the price of Ethereum and other market factors.

What are the rewards of investing in Ethereum mining stocks?

Potential rewards include high returns, exposure to the cryptocurrency market, and portfolio diversification. As the value of Ethereum increases, the profitability of mining operations can lead to higher stock prices.

How do I evaluate Ethereum mining stocks?

Evaluate these stocks by examining the company's financial health, mining efficiency, geographic location, technology and innovation, management team, and market position. Conduct thorough research to make informed investment decisions.

Are there any environmental concerns with Ethereum mining?

Yes, cryptocurrency mining can have a significant environmental impact due to high energy consumption. Companies that adopt sustainable practices and use renewable energy sources may have a competitive advantage.

What is the impact of Ethereum 2.0 on mining stocks?

Ethereum 2.0 involves a shift from Proof of Work (PoW) to Proof of Stake (PoS), reducing the need for traditional mining. Companies may need to adapt their business models to remain relevant in the changing landscape.

These FAQs address some of the common concerns and questions about investing in Ethereum mining stocks. By understanding these aspects, you can make more informed decisions and navigate the investment landscape more effectively.

Conclusion: Should You Invest in Ethereum Mining Stocks

Investing in Ethereum mining stocks can be a compelling opportunity for those looking to gain exposure to the cryptocurrency market without directly holding Ethereum. These stocks offer potential rewards such as high returns, market diversification, and indirect participation in the growth of Ethereum.

However, it's essential to consider the risks involved, including market volatility, regulatory changes, and technological advancements. Thorough research and careful evaluation of the companies' financial health, mining efficiency, and management team are crucial steps before making any investment decisions.

Given the dynamic nature of the cryptocurrency market and the ongoing transition to Ethereum 2.0, investors should stay informed about industry trends and be prepared to adapt their strategies accordingly. Diversifying your investment portfolio can also help mitigate risks and enhance potential returns.

Ultimately, whether you should invest in Ethereum mining stocks depends on your risk tolerance, investment goals, and understanding of the market. By weighing the pros and cons and conducting thorough research, you can make a more informed decision that aligns with your financial objectives.

Frequently Asked Questions About Investing in Ethereum Mining Stocks

What are Ethereum mining stocks?

Ethereum mining stocks are shares in publicly traded companies that mine Ethereum. These companies use specialized hardware to validate transactions on the Ethereum blockchain and earn rewards in the form of newly created Ethereum tokens.

How do I buy Ethereum mining stocks?

To buy Ethereum mining stocks, you need to open a brokerage account, fund it, and place an order for the stocks you want to purchase. Research and identify reputable companies involved in Ethereum mining before making your investment.

What are the risks of investing in Ethereum mining stocks?

Risks include market volatility, regulatory changes, technological advancements, and high operational costs. The value of these stocks can fluctuate significantly based on the price of Ethereum and other market factors.

What are the rewards of investing in Ethereum mining stocks?

Potential rewards include high returns, exposure to the cryptocurrency market, and portfolio diversification. As the value of Ethereum increases, the profitability of mining operations can lead to higher stock prices.

How do I evaluate Ethereum mining stocks?

Evaluate these stocks by examining the company's financial health, mining efficiency, geographic location, technology and innovation, management team, and market position. Conduct thorough research to make informed investment decisions.