Volatility

Volatility

Ever wondered about the phenomenon behind the peaks and troughs of bitcoin prices? This piece will illuminate the term volatility and how it plays a significant role in Bitcoin's world, particularly in Bitcoin mining.

Understanding Volatility

In finance and investments, volatility bears a great significance. It refers to the rate at which the price of an asset, such as Bitcoin, increases or decreases for a set of returns. Volatility is commonly measured by the standard deviation or variance between returns from that same asset or market index.

Volatility and Bitcoin

Bitcoin is a notoriously volatile digital asset. This means its price can change rapidly in a very short time, making it possible for investors to experience significant gains or losses. Factors such as regulatory news, market manipulation, and macroeconomic releases can create volatility in the Bitcoin markets.

Volatility Influence on Bitcoin Mining

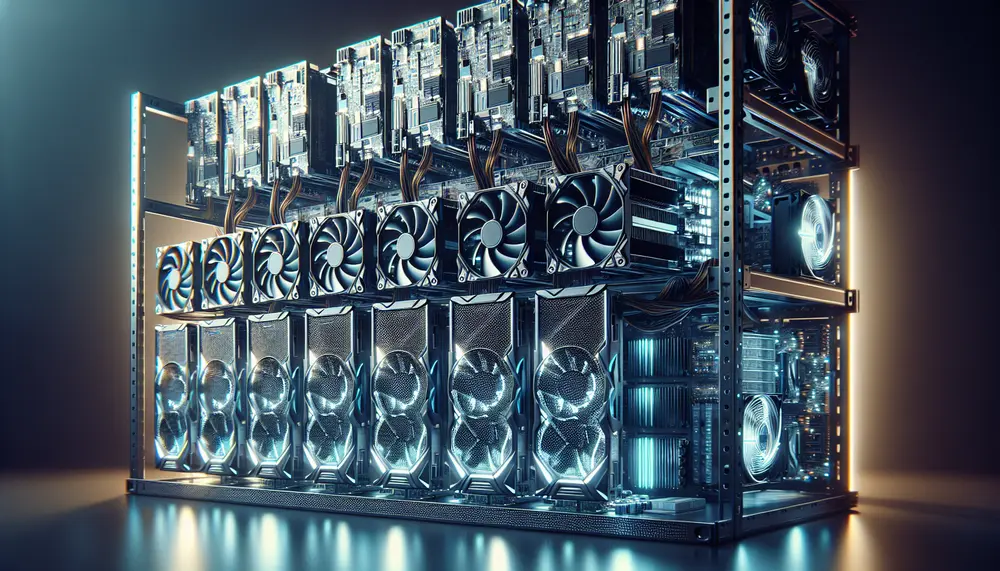

But how does volatility impact Bitcoin mining? Bitcoin mining is the process by which new Bitcoins are entered into circulation. It involves the use of sophisticated hardware to solve complex mathematical problems. When the price of Bitcoin increases rapidly (higher volatility), mining tends to become more attractive. On the other hand, if volatility leads to a price decrease, miners may choose to hold onto their newly minted Bitcoins, hoping for a price increase. As a result, miners play a crucial role in managing Bitcoin's volatility.

Volatility Index

The Volatility Index, often referred to as the 'Crypto VIX,' measures the market's expectation of 30-day forward-looking volatility. Investors and miners alike follow this closely to make informed decisions about their Bitcoin trading and mining activities.

Final Thoughts

Understanding the concept of volatility can help both miners and traders make informed decisions. In the end, it all boils down to risk and reward. High volatility might mean higher risk, but it also presents opportunities for high reward, particularly for those involved in Bitcoin mining.

Blog Posts with the term: Volatility

Cloud mining allows individuals to lease processing power from remote data centers for cryptocurrency mining, offering convenience and lower upfront costs but potentially reduced earnings and risks of scams. Hardware mining involves owning equipment with greater control and profit potential...

Real USDT mining apps allow users to mine Tether (USDT) directly from their smartphones or computers, offering a simplified and accessible entry point for both beginners and seasoned miners. These apps feature user-friendly interfaces, automated mining options, real-time earnings tracking,...

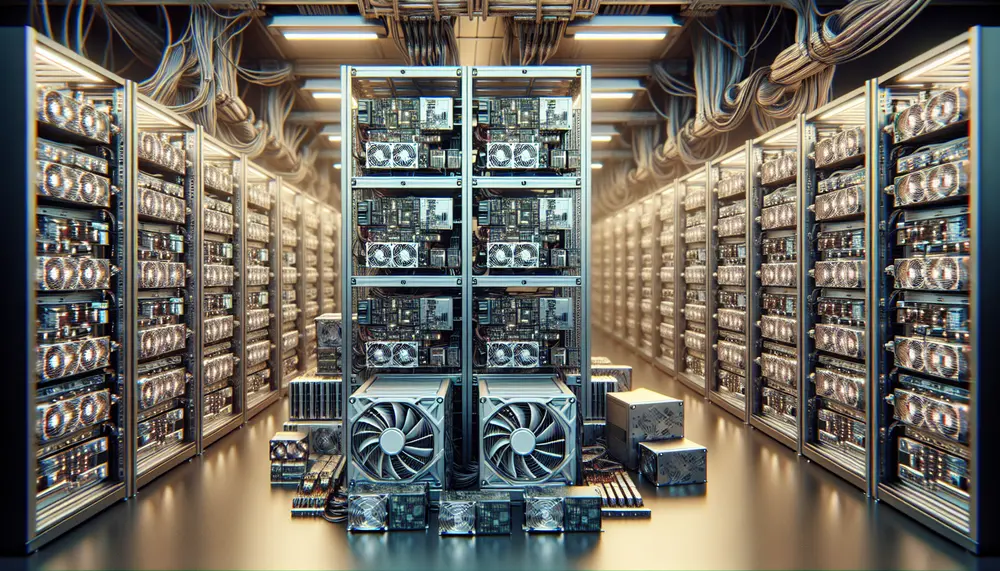

Bitcoin mining pools are groups of miners who combine their computing power to mine Bitcoin blocks and share the rewards. Joining a mining pool increases the frequency of payouts and reduces the volatility of the mining process, making it a...

When cashing out crypto from mining, choose your payout coin wisely by considering transaction fees, market volatility, liquidity, and future potential; also understand minimum withdrawal requirements to ensure efficient transactions....

The article discusses the increasing popularity of USDT (Tether) mining and highlights its benefits, such as stability and low entry barriers. It also provides criteria for selecting reliable USDT mining sites and lists top platforms to consider in 2024, including...

USDT (Tether) is a stablecoin pegged to the US Dollar, offering stability and liquidity in the cryptocurrency market. Unlike traditional cryptocurrencies that are mined, USDT can be earned through methods like liquidity mining, staking, and cloud mining; setting up involves...

USDT, or Tether, is a stablecoin pegged to the US Dollar and issued by Tether Limited through fiat collateralization, ensuring each token is backed by real-world assets. It plays a crucial role in cryptocurrency trading due to its stability and...

Dogecoin mining involves using computational power to solve mathematical problems, validating transactions and adding new blocks to the blockchain, with miners rewarded in Dogecoin. This guide covers the basics of Dogecoin mining hardware—CPUs, GPUs, and ASICs—and reviews top 2024 miners...

Cloud mining allows individuals to mine cryptocurrencies remotely by leasing power from data centers, and Binance offers such services through its platform. Users can purchase contracts on Binance Cloud Mining without needing personal hardware or technical knowledge, but profitability is...

Bitcoin's mining reward system, which reduces rewards through halving events approximately every four years to maintain scarcity and influence market dynamics, plays a crucial role in shaping Bitcoin's value and technological evolution. These halvings impact supply by capping it at...

USDT mining pools allow miners to combine computational power for more consistent rewards, with benefits including increased earnings and reduced costs. Key factors in choosing a pool include size, fees, payout structure, reputation, location of servers, support community, and security...

USDT mining investment involves earning USDT through cloud mining services, which mine other cryptocurrencies and convert them into USDT. While it offers benefits like stability, accessibility, passive income, and liquidity, potential investors should be cautious of platform reliability, lower returns...

This guide explores the essential aspects of using GPUs for Litecoin mining, covering hardware requirements, software setup, and optimization techniques to maximize efficiency. It explains how GPUs handle parallel processing tasks efficiently in the Scrypt algorithm used by Litecoin and...

Understanding your objectives for Bitcoin mining is crucial, as it influences decisions on hardware, location, and risk management; key cost factors include electricity rates, cooling needs, maintenance expenses, and network difficulty. Efficient hardware can reduce energy costs significantly but often...

Mining pool payout schemes determine how rewards are distributed among miners, with options like Pay-Per-Share (PPS) offering predictable payouts and others like Proportional rewarding based on contribution during block rounds. Each scheme has unique benefits tailored to different miner preferences...