Validation

Validation

Stepping into the vast world of Bitcoin Mining, you're likely to encounter a number of unique terms and phrases. One such term that holds key importance is "Validation". Understanding this concept isn't only crucial for miners, but also for those who want to transact using bitcoin.

What is Validation in Bitcoin Mining?

Validation in Bitcoin Mining refers to the process where miners confirm that a transaction is accurate and can be added to the blockchain. This process ensures the integrity, security, and consistency of the bitcoin network, making it resistant to fraud and double spending.

How does Validation Work?

When a transaction occurs in the bitcoin network, it isn't added to the blockchain right away. Instead, it first enters the memory pool (or the 'mempool') where it waits for a miner to validate it. The miner checks the transaction details such as the input and output addresses, and the signature to ensure that everything is in order. Upon validation, the miner then adds the transaction to a new block which is subsequently added to the blockchain.

The Significance of Validation

The process of validation serves as a safety measure, ensuring that only legitimate transactions make their way onto the blockchain. It prevents bad actors from double-spending coins or creating coins out of thin air. It also maintains the integrity of the network by making sure everyone follows the rules. Therefore, validation is a critical factor in the decentralization and trustless nature of Bitcoin.

Validation and the Mining Reward

As a reward for their work, miners receive transaction fees and a certain amount of bitcoins (known as the 'block reward') when they successfully mine a new block. The system incentivizes miners to perform validation to ensure the blockchain’s ongoing security.

Understanding validation adds a new layer of clarity to Bitcoin Mining. So next time you make a bitcoin transaction, you can appreciate it for the secure and verified process that it is.

Blog Posts with the term: Validation

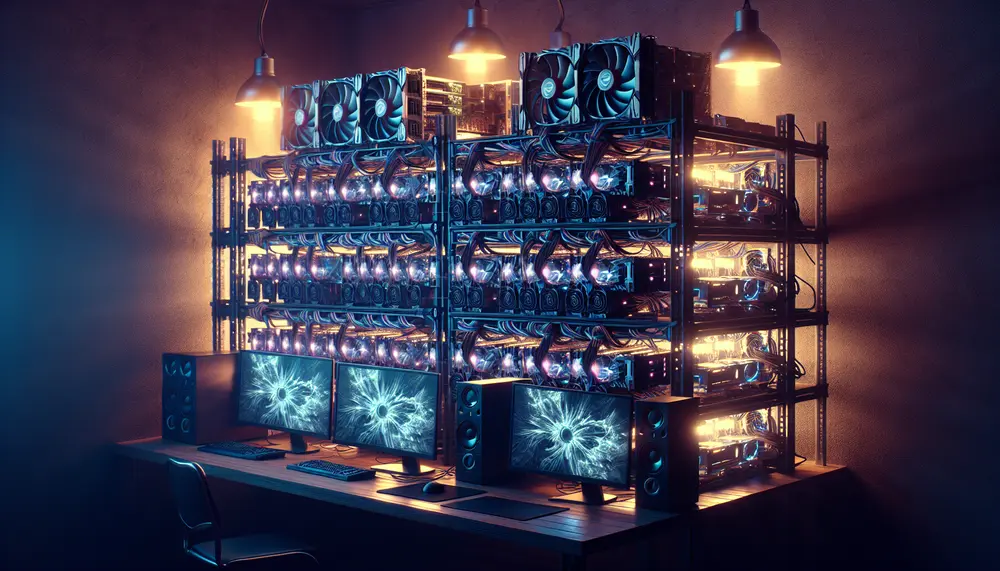

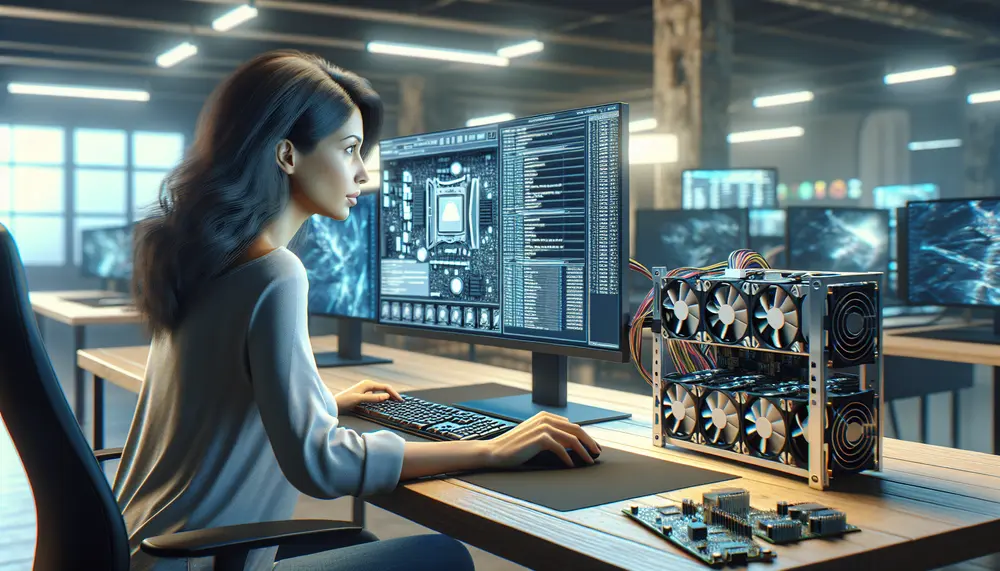

This guide provides a comprehensive overview of setting up an Ethereum mining rig, covering essential components like GPUs and motherboards, as well as key concepts such as Proof of Work (PoW) and hashrate. By the end, readers will understand how...

XRP, created by Ripple Labs in 2012, is designed for fast and cost-effective cross-border transactions using a semi-centralized ledger maintained by independent validator nodes. Unlike Bitcoin and Ethereum, XRP cannot be mined as all its tokens were pre-mined at inception;...

USDT mining simulation offers a risk-free, cost-effective way for beginners to learn about cryptocurrency mining by mimicking the process of validating transactions and earning virtual rewards in a controlled environment. This educational tool provides hands-on experience without financial risks or...

The article explores the profitability of XRP mining, highlighting its unique consensus algorithm and how it differs from traditional cryptocurrencies like Bitcoin. It covers key factors influencing profitability such as transaction fees, network activity, hardware costs, energy consumption, market value...

Setting up a Verus node involves downloading and installing the Verus software, ensuring your system meets specific requirements, and configuring the node to participate in transaction validation, block creation, network security, and data propagation. Running a Verus node enhances security...

XRP, created by Ripple Labs in 2012, is a pre-mined digital asset designed for fast and cost-effective cross-border payments using the Ripple Protocol Consensus Algorithm (RPCA) instead of traditional mining. Unlike Bitcoin's Proof of Work system, XRP relies on validators...

Pyrin mining pools allow miners to collaborate using the PyrinHashV2 algorithm, optimized for GPUs, offering more predictable rewards and community support compared to solo mining. Choosing a pool involves considering factors like payout methods (e.g., PPS or PPLNS), fees, server...

Ethereum mining originated from Vitalik Buterin's vision in 2013 for a blockchain that could support complex applications, leading to the launch of Ethereum with smart contract capabilities on July 30, 2015. The network's growth was fueled by an innovative crowdfunding...

Solana mining, or staking, involves locking up SOL tokens to support the network using a Proof of Stake (PoS) mechanism rather than power-intensive hardware. Efficient Solana mining requires key components like powerful CPUs, adequate RAM (at least 64GB), fast SSDs,...

Solana is a high-performance blockchain utilizing Proof-of-Stake (PoS) and Proof of History (PoH) for efficient, scalable transaction processing. Staking on Solana involves locking SOL tokens to support network security in exchange for rewards, requiring robust hardware like multi-core CPUs, ample...

This guide provides a comprehensive overview of how to start Solana mining on mobile devices, covering everything from setting up your device and choosing the right wallet to selecting a validator and optimizing rewards. It highlights the advantages of using...

Solana mining offers a profitable venture due to its high-speed transactions and low fees, utilizing an efficient Proof of Stake model. To start, acquire SOL tokens, set up a validator node with appropriate hardware and software, stake your tokens, and...

Litecoin merge mining allows miners to simultaneously mine Litecoin (LTC) and Dogecoin (DOGE) using the same hardware setup, leveraging Auxiliary Proof of Work (AuxPoW) to enhance profitability and network security. This method increases earnings without additional equipment investment, making it...

The article explores the introduction of crypto mining from an Urdu perspective, emphasizing its importance in making technology accessible to millions who speak the language by breaking down complex digital concepts into understandable terms. It delves into how cryptocurrency and...