Real USDT mining apps allow users to mine Tether (USDT) directly from their smartphones or computers, offering a simplified and accessible entry point for both beginners and seasoned miners. These apps feature user-friendly interfaces, automated mining options, real-time earnings tracking,...

Mining USDT in Trust Wallet is a straightforward process that involves setting up the wallet, funding it with USDT, and connecting to a reputable mining pool. Trust Wallet's user-friendly interface, robust security features, and wide compatibility make it an excellent...

USDT (Tether) is a stablecoin pegged to the US Dollar, offering stability and liquidity in the cryptocurrency market. Unlike traditional cryptocurrencies that are mined, USDT can be earned through methods like liquidity mining, staking, and cloud mining; setting up involves...

Monero mining involves validating transactions using computational power, with miners rewarded through a combination of decreasing block rewards and transaction fees. The unique tail emission mechanism ensures perpetual miner incentives by stabilizing the reward at 0.6 XMR per block once...

USDT, or Tether, is a stablecoin pegged to the US Dollar and issued by Tether Limited through fiat collateralization, ensuring each token is backed by real-world assets. It plays a crucial role in cryptocurrency trading due to its stability and...

USDT mining, which involves generating Tether through liquidity mining or staking rather than traditional cryptocurrency mining, has seen a rise in scams exploiting investor interest with fake websites and promises of high returns. To avoid falling victim to these schemes,...

Ethereum mining can be profitable but carries risks, including scams that lead to financial losses. This article explains how to identify common Ethereum mining pool scams and provides tips for protecting your investments by recognizing red flags such as unrealistic...

Bitcoin's mining reward system, which reduces rewards through halving events approximately every four years to maintain scarcity and influence market dynamics, plays a crucial role in shaping Bitcoin's value and technological evolution. These halvings impact supply by capping it at...

USDT mining investment involves earning USDT through cloud mining services, which mine other cryptocurrencies and convert them into USDT. While it offers benefits like stability, accessibility, passive income, and liquidity, potential investors should be cautious of platform reliability, lower returns...

XRP, created by Ripple Labs in 2012, is designed for fast and cost-effective cross-border transactions using a semi-centralized ledger maintained by independent validator nodes. Unlike Bitcoin and Ethereum, XRP cannot be mined as all its tokens were pre-mined at inception;...

USDT DeFi Mining allows users to earn rewards by leveraging decentralized finance protocols using the stablecoin USDT, offering benefits like stable returns and passive income but also posing risks such as smart contract vulnerabilities and market volatility. This guide covers...

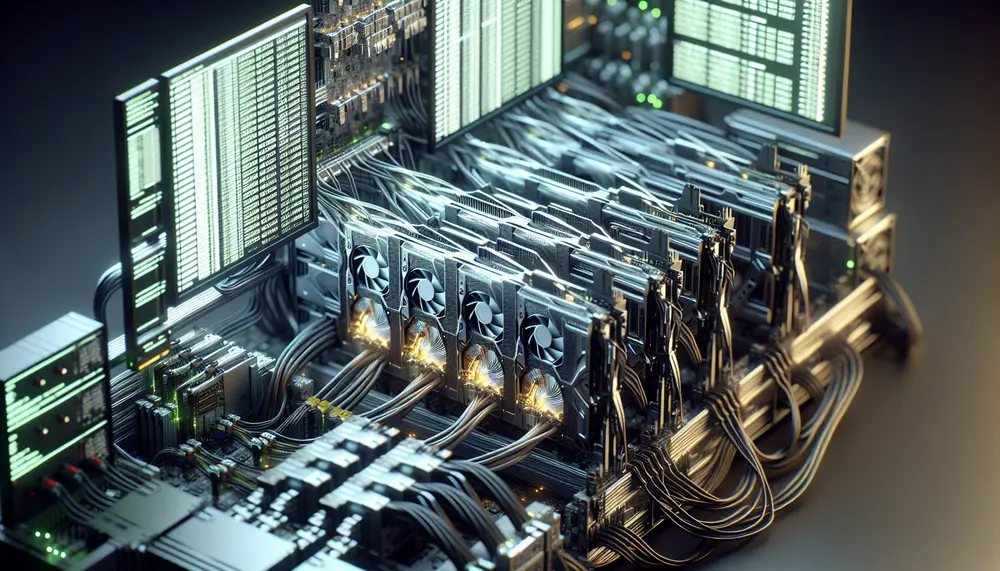

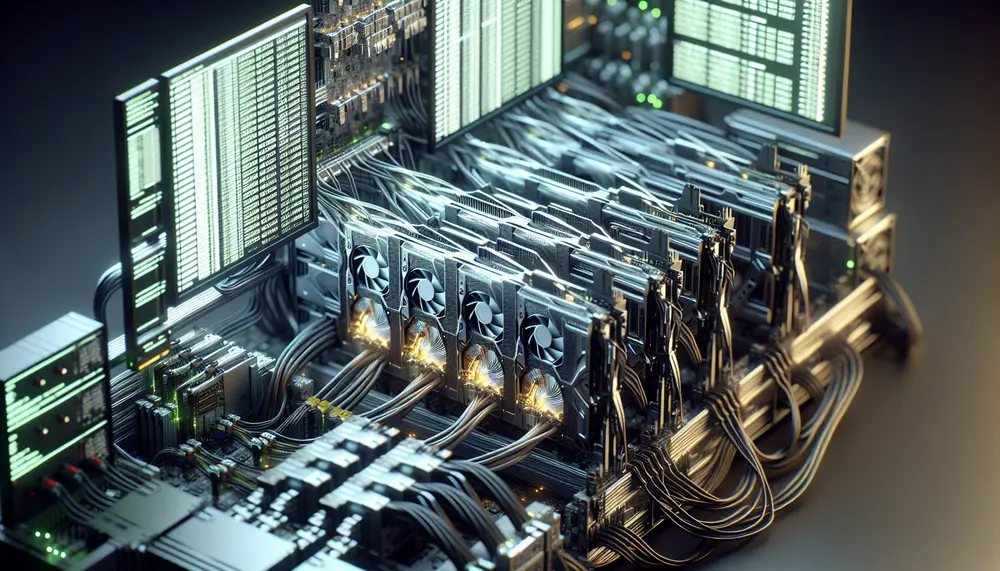

The article explores the best GPUs for efficient Ravencoin mining, highlighting key factors such as hashrate, power consumption, price, cooling and durability, and availability. It recommends top-performing NVIDIA (RTX 3080 Ti, RTX 3090) and AMD (Radeon VII, RX 6800 XT)...

Mining taxes significantly influence global economic growth and investment attractiveness, with varied systems reflecting national priorities; understanding these helps ensure fair wealth distribution from natural resources. Effective tax rates (ETRs) are crucial for balancing investment attraction and revenue collection, impacting...

Verus Coin GPU mining is popular due to its ASIC-resistant VerusHash algorithm, allowing efficient mining with GPUs. The article guides on optimizing your setup by choosing the right GPU, setting up and configuring software, overclocking safely, adjusting power settings, and...

The article explains the Verus Coin block reward system, detailing how miners receive VRSC for validating new blocks and discussing factors like network difficulty, hashrate, electricity costs, hardware efficiency, market price of VRSC, and block reward halving that influence mining...