Equity

Equity

Understanding Equity in Bitcoin Mining

In the world of Bitcoin mining, the term 'Equity' isn't the simplest concept to grasp, especially for beginners. However, once you understand it, equity will make dealing with Bitcoin mining all the more insightful.

Basics of Equity

Although usually associated with finance and business, 'Equity' in Bitcoin mining assumes a slightly different meaning. Typically, equity refers to ownership interest in an enterprise. This could mean stocks, shares or any form of security that represents ownership.

Equity in Bitcoin Mining

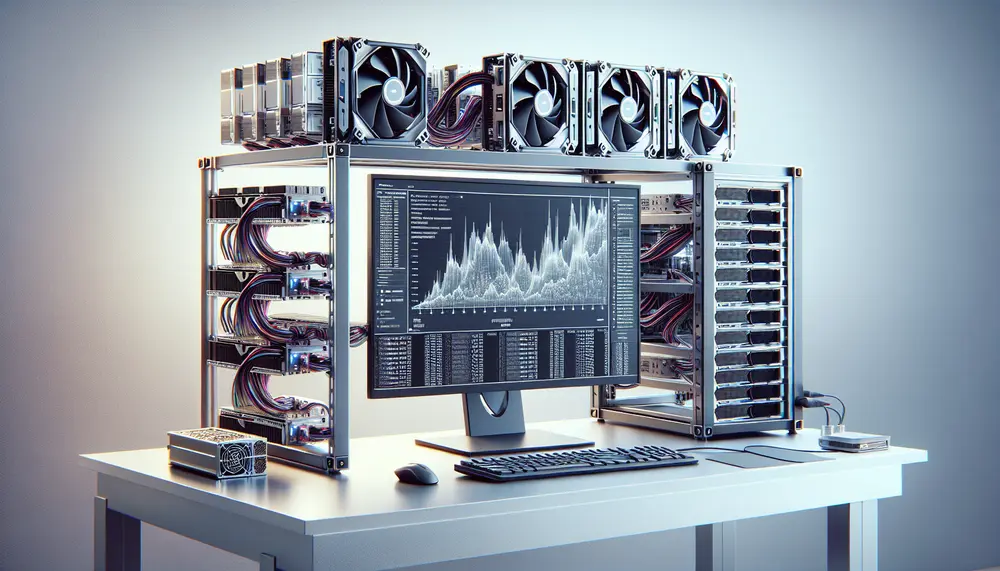

In the context of Bitcoin mining, however, Equity takes on a unique significance. It often refers to the financial value a miner contributes to the mining process. This includes the costs for mining equipment, such as high-powered computers, electricity bills, and maintenance costs. In other words, a miner's equity is the total value of resources allocated to the mining operations.

Investing Equity in Mining Operations

Miners invest their Equity on the premise that the bitcoins they successfully mine and earn as rewards can outweigh their initial equity investment. The successful return of these bitcoins essentially makes up for the equity used.

Risk and Reward in Equity Mining

Nonetheless, investing equity in Bitcoin mining comes with risks. The potential financial reward of mining bitcoins is often weighed against these risks which include the unpredictable nature of Bitcoin's value, its price volatility, and the growing difficulty of mining activities over time.

Equity: An Essential Mining Ingredient

All things considered, Equity is a crucial component in the Bitcoin mining landscape. It's an investment that drives the mining operations forward. While risks are an inherent part of the process, understanding how equity works can enhance the mining strategy, thus leading to a more efficient and profitable mining operation.

Blog Posts with the term: Equity

Mining taxation in South Africa is crucial for the economy, influencing mining operations and ensuring resource wealth benefits all stakeholders through mineral royalties, corporate income tax, VAT considerations, and capital gains tax. Understanding these taxes helps balance fair compensation with...

Islamic finance aligns with ethical teachings of Islam, emphasizing fairness and avoiding interest (riba), excessive uncertainty (gharar), and gambling-like activities (maisir); while cryptocurrencies intrigue due to their decentralized nature, they pose challenges regarding volatility and speculative use that may conflict...

Hut 8's hashrate reached 22.3 EH/s in January 2024, with strategic growth through partnerships and infrastructure developments enhancing their mining capacity and financial stability. These efforts position Hut 8 as a leader in the crypto mining industry, offering valuable opportunities...

The article explores whether Tether (USDT) mining is halal by examining Islamic finance principles such as the prohibition of riba and gharar, transparency, ethical conduct, and asset-backed transactions. It presents diverse perspectives from Islamic scholars who debate USDT's permissibility based...

Pakistan plans to establish a national Bitcoin reserve and dedicate 2,000 MW for BTC mining, signaling growing global state adoption of Bitcoin as a strategic asset....

Crypto mining companies validate and add transactions to the blockchain using significant computational power, with different types such as self-mining firms, hosting services, and cloud providers. Evaluating these companies involves assessing financial health, technological capabilities, sustainability practices, market position, and...

The article explores whether Ethereum mining is halal or haram according to Islamic law, examining key principles like riba (interest), gharar (uncertainty), and maysir (gambling). It presents arguments for both sides, considering factors such as energy consumption, transparency, effort involved,...

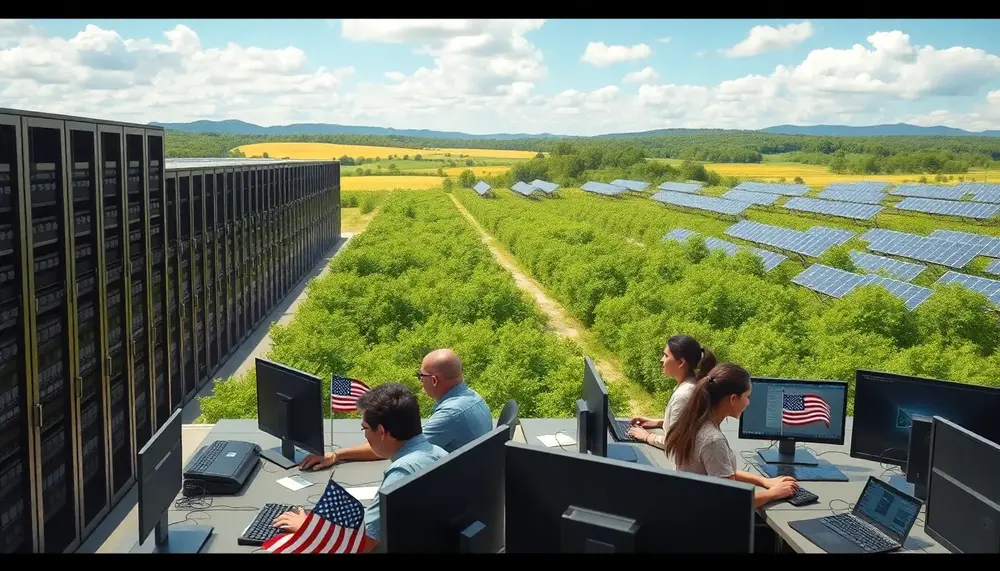

The articles discuss Bitcoin mining as a potential solution for managing Germany's renewable energy surplus and Powerhive-Telcoin's blockchain-based mobility financing platform to empower emerging markets....

CleanSpark faces market pressure and stock declines amid hardware delays but pursues aggressive expansion, while Bitcoin mining is rapidly shifting to renewables by 2030. Riot adapts to post-halving challenges by selling BTC and securing credit lines, reflecting broader industry pressures....

The repeal of Australia's mining tax has freed up capital for mining companies, potentially redirecting investments into innovative sectors like cryptocurrency and emerging technologies. This shift could lead to increased research in blockchain, institutional investment in digital currencies, and a...

Bitcoin hit a new all-time high of $109,700 driven by institutional inflows, regulatory momentum, and its unique scarcity, though market corrections remain possible....

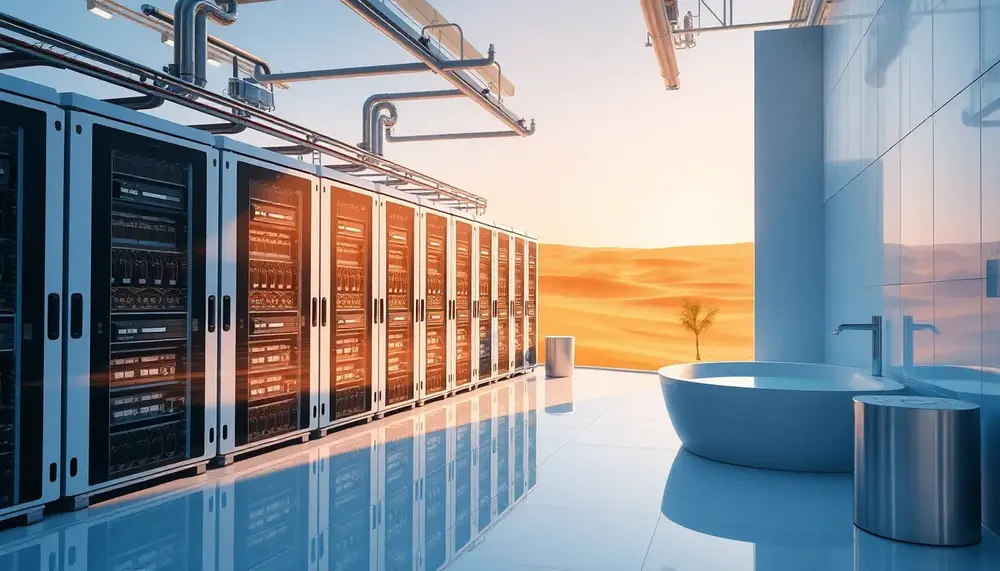

MARA Holdings plans a $2 billion stock offering to expand its Bitcoin reserves, while the UAE invests $1.4 trillion in U.S. Bitcoin mining; meanwhile, a New York spa using Bitcoin mining for heating faces hygiene concerns amidst customer complaints and...

Compass Mining launched a 20 MW hydro-cooled Bitcoin mining facility in North Dakota, while Core Scientific saw stock gains despite Q4 losses and Gryphon revised its Erikson acquisition. Meanwhile, Bitcoin faces market corrections but showed slight recovery alongside other cryptocurrencies...

Industry expert John Glover advises Bitcoin miners to hold BTC and use it as loan collateral amid rising costs, despite a record 40% sell-off in March 2025....

Canaan and HIVE reported significant growth in Bitcoin mining capacity and reserves, with miners shifting from selling to accumulating BTC, signaling renewed market optimism. Despite profitability challenges, both companies are expanding operations through strategic partnerships and technological innovation....