Table of Contents:

Iris Energy: Strategic Shift Between Bitcoin Mining and AI Infrastructure

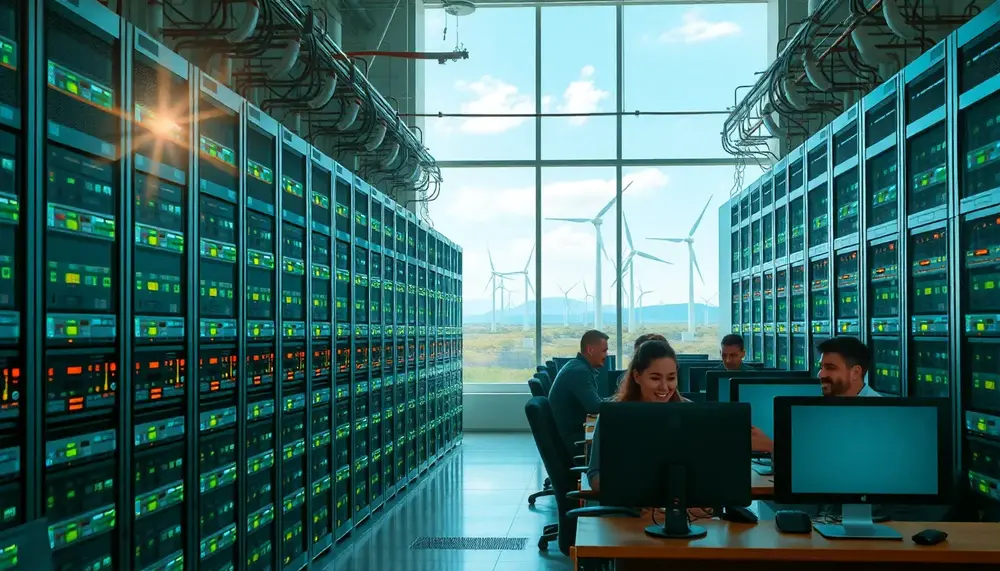

Iris Energy is currently at the center of a heated debate among analysts and investors, as reported by Börse Express. The company has expanded its mining capacity to 40 EH/s but has simultaneously scaled back its Bitcoin expansion efforts. Instead, Iris Energy is now focusing more on AI and high-performance computing infrastructure, a bold move in a highly competitive market.

Financial forecasts for Iris Energy remain ambitious. The company expects a significant increase in EBITDA for the fiscal year 2026 and may even achieve long-awaited profitability as early as this year. There is also speculation about a potential Bitcoin dividend starting in 2025, which has further fueled discussions.

Analyst opinions are divided:

- B. Riley reduced its price target from $21 to $14 but maintains a "Buy" rating.

- BTIG and Cantor Fitzgerald see potential up to $23.

- The average analyst price target currently stands at $22.

The sector's volatility is underscored by the recent suspension of Argo Blockchain's stock trading on the London Stock Exchange, serving as a warning to the entire industry. The key question remains whether Iris Energy's dual strategy of mining and AI can deliver long-term success or if further market turbulence could lead to a sharper decline in the stock.

| Analyst | Price Target (USD) | Rating |

|---|---|---|

| B. Riley | 14 | Buy |

| BTIG | 23 | n/a |

| Cantor Fitzgerald | 23 | n/a |

| Average | 22 | n/a |

Summary: Iris Energy is pursuing a risky but potentially rewarding shift towards AI infrastructure, with analysts split on the company's future. The average price target is $22, but recent sector volatility highlights the risks involved. (Source: Börse Express)

Bitcoin Mining No Longer Profitable: Rising Costs Outpace Market Value

According to PC-Welt, recent reports indicate that Bitcoin mining is no longer profitable. The cost to mine a single Bitcoin in 2025 is estimated at $137,000 (approximately €120,750) in electricity alone, while the current market value of one Bitcoin is about $95,000 (around €83,730). Even at its all-time high of over €100,000 earlier this year, mining remains a loss-making venture, even under ideal conditions with cheap electricity and hardware.

This development was inevitable due to the Bitcoin protocol, which increases mining difficulty as more coins are mined. The report, citing Coinshares, highlights that the era of easy profits from mining with powerful graphics cards is over. While alternative cryptocurrencies or trading may still offer opportunities, the straightforward conversion of electricity and hardware into digital gold is no longer viable.

| Cost to Mine 1 BTC (2025) | Market Value 1 BTC | All-Time High (2024) |

|---|---|---|

| $137,000 | $95,000 | over €100,000 |

Summary: The cost of mining Bitcoin now far exceeds its market value, making the activity unprofitable for most miners. The shift marks the end of an era for easy mining profits. (Source: PC-Welt)

USA: From Opponent to Global Leader in Bitcoin Mining

Bit2Me News reports that the United States has transitioned from a cautious stance to active support for Bitcoin mining, aiming to become the global epicenter of the industry. U.S. Secretary of Commerce Howard Lutnick announced a plan inviting miners to build autonomous power plants near natural gas fields, reducing operational costs and dependence on the public grid.

This strategy is designed to make mining more efficient and environmentally responsible by utilizing waste gas as fuel. Lutnick emphasized that the current administration, including himself and David Sacks, is supportive of Bitcoin, marking a significant shift from previous regulatory uncertainty. The initiative is expected to reduce grid strain, foster energy infrastructure investment, create jobs, and position the U.S. as a net exporter of Bitcoin network computing power.

- Miners are encouraged to build power plants near gas fields.

- Reduces reliance on public electricity and operational costs.

- Promotes use of waste gas, supporting environmental goals.

- Signals strong political and regulatory support for the industry.

Summary: The U.S. is actively promoting Bitcoin mining with innovative energy strategies, aiming to lead the global industry and support economic growth. (Source: Bit2Me News)

Bitcoin Mining and Renewable Energy: Cambridge University Study

A new report from Cambridge University, summarized by Blockchainwelt, reveals a significant trend towards renewable energy in Bitcoin mining. The study, which analyzed data from 23 countries, found that 52.4% of the Bitcoin network's energy comes from sustainable sources, including 9.8% nuclear and 42.6% renewables such as hydro and wind power.

The use of natural gas has overtaken coal as the primary energy source, with 38.2% of miners now using gas compared to 25% in 2022. Coal usage has dropped sharply from 36.6% to just 8.9%. The annual energy consumption of the Bitcoin network is estimated at 138 terawatt-hours, about 0.5% of global electricity use, resulting in emissions of 39.8 megatons of CO2 equivalent.

The United States has further strengthened its position, now accounting for 75.4% of global Bitcoin mining computing power, up from 37.8% in 2022. Together with Canada, North America represents 82.5% of the global total.

| Energy Source | 2022 (%) | 2024 (%) |

|---|---|---|

| Renewables | 37.6 | 42.6 |

| Nuclear | n/a | 9.8 |

| Natural Gas | 25 | 38.2 |

| Coal | 36.6 | 8.9 |

Summary: Over half of Bitcoin mining now uses sustainable energy, with a marked shift from coal to natural gas and renewables. The U.S. dominates global mining capacity. (Source: Blockchainwelt)

ZA Miner Launches Free Cloud Mining Platform for Bitcoin and Dogecoin

According to Finanzen.net, ZA Miner has introduced a new free cloud mining platform for Bitcoin and Dogecoin. This service allows users to participate in cryptocurrency mining without upfront hardware investments or ongoing maintenance costs.

The platform is designed to lower the entry barrier for individuals interested in mining, offering a user-friendly interface and the ability to mine both Bitcoin and Dogecoin. This move is expected to attract a broader audience to the mining sector, especially those who previously found the technical and financial requirements prohibitive.

- Free access to cloud mining for Bitcoin and Dogecoin.

- No hardware purchase or maintenance required.

- Targeted at newcomers and those seeking a low-risk entry into mining.

Summary: ZA Miner’s free cloud mining platform democratizes access to Bitcoin and Dogecoin mining, potentially expanding the user base and lowering barriers to entry. (Source: Finanzen.net)

Sources:

- Iris Energy: Zwischen Bitcoin-Mining und KI-Ambitionen

- Phoenix Group erhöht Bitcoin-Mining-Kapazität in Äthiopien auf 132 MW

- Bitcoin-Mining ist nicht mehr profitabel

- Vom Feind zum Verbündeten: USA wollen Bitcoin-Mining mit autonomen Kraftwerken dominieren

- Bitcoin Mining: So viel erneuerbare Energie nutzt BTC wirklich

- ZA Miner führt kostenlose Cloud-Mining-Plattform für Bitcoin und Dogecoin ein