Table of Contents:

CleanSpark Faces Pressure Amid Market Volatility

CleanSpark, a prominent Bitcoin mining company, is currently under significant pressure as the entire Bitcoin mining sector faces a challenging environment. According to Börse Express, CleanSpark is on the verge of releasing its quarterly results, with analysts expecting revenue of approximately $195 million. The company is grappling with hardware delivery delays, which have forced it to expand credit lines to maintain liquidity—a risky move in an already tense market.

Despite these headwinds, CleanSpark remains committed to its ambitious expansion plans, aiming to reach a hash rate of 50 ExaHash by mid-2025. The company is also exploring further expansion opportunities to strengthen its market position. However, investor skepticism is evident: since its 52-week high in July 2024, the stock has lost more than half its value. A modest recovery from the March low of $6.72 to around $8 offers little comfort, and a Relative Strength Index (RSI) of 26.1 indicates the stock is technically oversold.

Get $500 free Bitcoin mining for a free testing phase:

- Real daily rewards

- 1 full month of testing

- No strings attached

If you choose to buy after testing, you can keep your mining rewards and receive up to 20% bonus on top.

| Metric | Value |

|---|---|

| Expected Q2 Revenue | $195 million |

| Hashrate Target (mid-2025) | 50 ExaHash |

| March Low | $6.72 |

| Current Price (approx.) | $8 |

| RSI | 26.1 |

- CleanSpark is expanding credit lines to secure liquidity.

- Stock has lost over 50% since July 2024 high.

- Ambitious hash rate expansion continues despite market skepticism.

Summary: CleanSpark is navigating a difficult market with delayed hardware deliveries and falling stock prices, but maintains aggressive growth targets. The upcoming quarterly results and Bitcoin market trends will be decisive for the company's future. (Source: Börse Express)

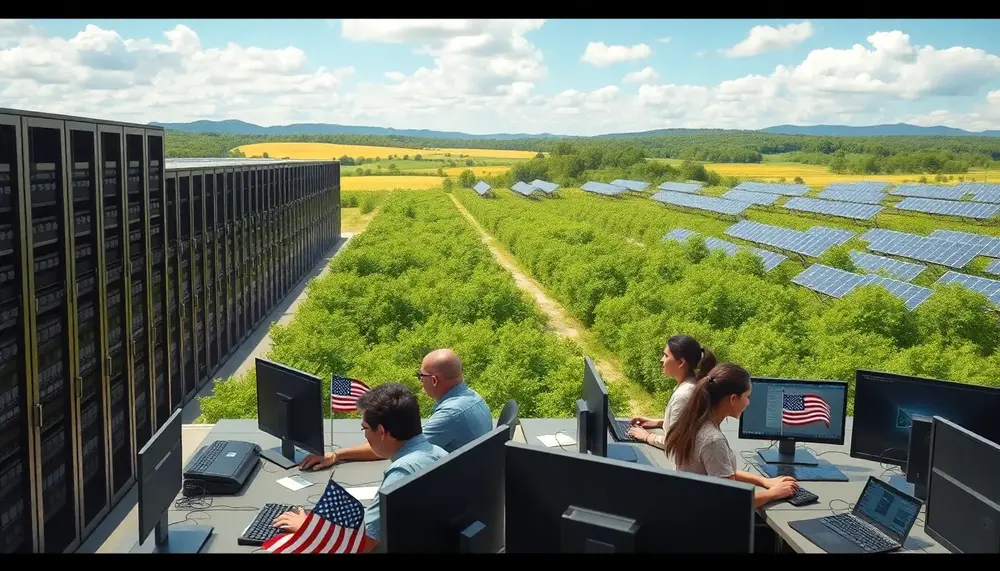

Green Bitcoin: The Path to Sustainable Mining by 2030

According to Bit2Me News, the Bitcoin mining industry is undergoing a significant transformation towards sustainability. Currently, nearly half of the energy used in Bitcoin mining comes from renewable sources. A report by the MiCA Crypto Alliance and Nodiens projects that by 2030, over 70% of Bitcoin mining will be powered by renewables. This shift is driven by technological advancements and regulatory measures aimed at reducing the sector's environmental impact.

In 2011, 63% of Bitcoin mining energy came from conventional sources, but by 2024, coal usage dropped to 20%, and renewables increased from 20% to 41%. The Cambridge Centre for Alternative Finance reports that clean energy usage in Bitcoin mining reached 52.4% in Q1 2024, up from 37.6% in 2022. Legislative initiatives, such as the "Clean Air in the Cloud" Act in the US and El Salvador's geothermal projects, are accelerating this green transition.

| Year | Renewable Energy Share | Coal Usage |

|---|---|---|

| 2011 | 20% | 63% |

| 2024 | 41% (up to 52.4% in Q1) | 20% |

| 2030 (projected) | 70%+ | - |

- Legislation and public policy are promoting clean energy adoption in mining.

- Bitcoin mining is increasingly seen as a stabilizer for power grids by consuming excess renewable energy during low demand.

- Technological innovation and diversification of energy sources are reducing costs and increasing competitiveness.

Summary: By 2030, Bitcoin mining is expected to be predominantly powered by renewable energy, significantly reducing its environmental footprint and aligning with global sustainability goals. (Source: Bit2Me News)

Riot Sells $38.8 Million in Bitcoin Amid Halving Pressure

Riot Platforms, one of the largest publicly traded Bitcoin miners in the US, sold $38.8 million worth of Bitcoin in April, according to Cryptodnes.bg. The company sold 475 BTC at an average price of $81,731 per coin, mainly from newly mined tokens, with a small portion from reserves. Despite the sale, Riot still holds over 19,000 BTC, valued at around $1.8 billion.

The sale was a strategic move to fund operations without relying heavily on equity financing, thus avoiding further shareholder dilution. The recent Bitcoin halving, which cut block rewards in half, has squeezed miners' margins. Riot's Bitcoin production fell by 13% in April compared to the previous month, even as mining difficulty rose 35% year-over-year to over 119 trillion hashes. To bolster liquidity, Riot secured a $100 million Bitcoin-backed credit line from Coinbase Credit.

| Metric | Value |

|---|---|

| BTC Sold (April) | 475 BTC |

| Average Sale Price | $81,731 |

| Total Value Sold | $38.8 million |

| BTC Holdings | 19,000+ BTC ($1.8 billion) |

| Mining Difficulty (YoY) | +35% (to 119 trillion hashes) |

| BTC-backed Credit Line | $100 million |

- Riot's production dropped 13% in April despite stable hash rate.

- Industry-wide, 15,000 BTC were sold in a single day on April 7, marking one of the largest daily outflows of the year.

- Riot's move reflects a broader trend of miners selling more reserves to stay afloat amid rising costs and competition.

Summary: Riot is adapting to post-halving pressures by selling Bitcoin and securing new credit lines, reflecting the broader challenges facing miners as costs rise and margins shrink. (Source: Cryptodnes.bg)

IREN Expands Mining Capacity and Eyes AI Data Center Market

IREN Limited (NASDAQ: IREN), a key player in Bitcoin mining and AI cloud services, reported significant operational growth for April 2025, as detailed by Investing.com Deutsch. The company increased its mining capacity to 40 EH/s and aims to reach 50 EH/s by June 30, 2025. In April, IREN mined 3,579 BTC, up from 533 BTC in March, generating $50.1 million in revenue at an average price of $86,522 per Bitcoin. The company boasts a gross profit margin of 90.06% and a hardware profit margin of 72%, with electricity costs at $24,381 per Bitcoin.

IREN's AI cloud services also saw a 27% revenue increase over March, reaching $2 million with nearly full fleet utilization and a hardware margin of 98%. The company is preparing to launch its Horizon 1 AI data center in the second half of 2025, focusing on liquid cooling for NVIDIA Blackwell GPUs. IREN is also advancing its Childress and Sweetwater projects, with Sweetwater 2 aiming for a 2GW data center node by late 2027. The company has paused its mining expansion at 52 EH/s to focus on AI cloud growth and has secured an additional 600MW grid connection in West Texas.

| Metric | Value |

|---|---|

| Mining Capacity (April 2025) | 40 EH/s |

| BTC Mined (April) | 3,579 BTC |

| Revenue (April) | $50.1 million |

| Gross Profit Margin | 90.06% |

| Hardware Margin (Mining) | 72% |

| Electricity Cost per BTC | $24,381 |

| AI Cloud Revenue (April) | $2 million |

| Hardware Margin (AI) | 98% |

| Horizon 1 Project CapEx | $300-350 million |

- IREN is shifting focus from mining expansion to AI cloud services.

- Significant infrastructure projects are underway, including a 2GW data center node.

- Analysts maintain an "Outperform" rating, citing potential from decentralized technologies.

Summary: IREN is rapidly expanding both its mining and AI cloud capacities, with strong financial performance and a strategic pivot towards AI infrastructure. (Source: Investing.com Deutsch)

US Dominates Global Bitcoin Mining: Decentralization at Risk?

MarketScreener Deutschland reports that as of 2025, the United States controls over 75% of global Bitcoin mining capacity, amounting to about 600 Exahashes per second out of a total 796 EH/s. This dominance raises concerns about the decentralization of the Bitcoin network. Howard Lutnick, former CEO of Cantor Fitzgerald and current US Secretary of Commerce, views this as a strategic opportunity, likening Bitcoin to gold and advocating for US industrial dominance in mining.

Historically, China controlled 65-75% of the hash rate until its 2021 mining ban, after which the US took the lead. The US federal system provides some protection against central control, as states like Texas and North Dakota benefit economically from mining and may resist federal intervention. However, the risk remains that regulatory measures could gradually undermine Bitcoin's decentralized ethos.

| Region | Hashrate Share | Hashrate (EH/s) |

|---|---|---|

| USA (2025) | 75.4% | 600 |

| Global Total | 100% | 796 |

| China (pre-2021) | 65-75% | - |

- US miners could theoretically censor transactions, but protocol rules are enforced by thousands of independent nodes.

- Even with 75% hash rate, miners cannot change Bitcoin's protocol or steal coins without private keys.

- The real risk is gradual regulatory encroachment rather than outright control.

"Bitcoin is like gold. A commodity." – Howard Lutnick, US Secretary of Commerce (MarketScreener Deutschland)

Summary: The US now overwhelmingly dominates global Bitcoin mining, raising questions about the future of decentralization and the potential for regulatory influence over the network. (Source: MarketScreener Deutschland)

Sources:

- CleanSpark Aktie: Bitcoin-Miner unter Druck

- Green Bitcoin: So wird die nachhaltige Krypto-Mining-Revolution im Jahr 2030 aussehen.

- Riot verkauft Bitcoin im Wert von $38.8 Millionen angesichts des Halbierung-Drucks und steigender Kosten

- IREN erweitert Mining-Kapazität und visiert den KI-Rechenzentrumsmarkt an

- Bitcoin: Wenn Amerika die Maschine kontrolliert - Crypt On It

- Bitcoin-Kurs im Mai: Allzeithoch oder 'sell in may, go away'?