September's Challenges for Bitcoin Miners

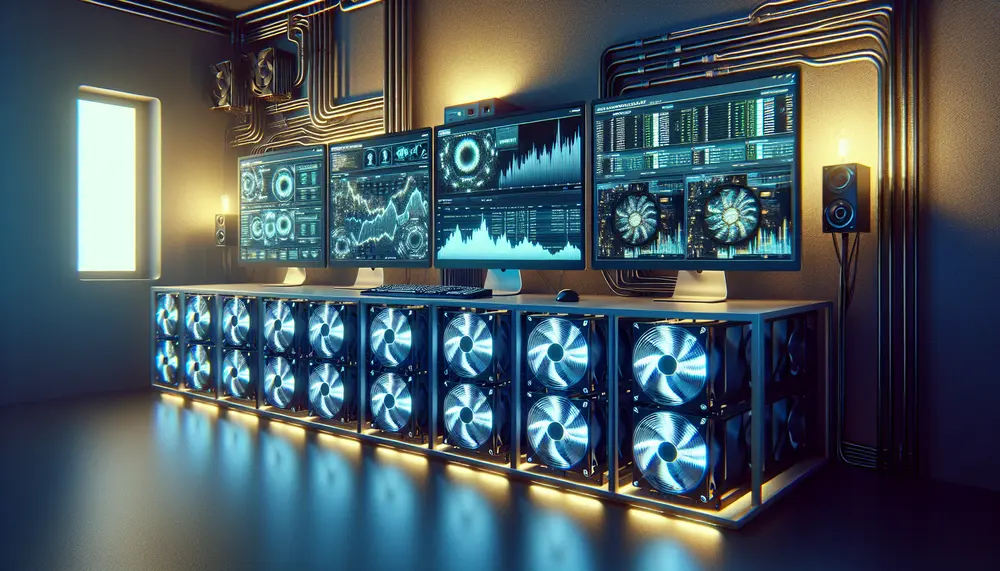

The month of September proved particularly challenging for Bitcoin miners, marking the worst period since the last halving event. According to Crypto News Flash, miner revenues took a hit due to an increase in network hash rate and mining difficulty. This led to reduced rewards and higher operational costs, significantly impacting profitability. The average revenue per exahash dropped by 6%, further squeezing profits.

Despite efforts from companies like Bitfarms to improve efficiency, production still declined amid these challenges. Larger firms such as Hut 8 and Iris Energy have been attempting to scale up operations; notably, Iris increased its output by 42% during this difficult time. However, maintaining profitability remains tough with rising complexity within the network.

This situation has prompted some miners to explore alternative avenues such as artificial intelligence (AI) and high-performance computing investments. For instance, Terawulf sold a portion of its stake in Nautilus aiming at AI advancements in New York facilities—an indication that staying competitive requires embracing cutting-edge technology amidst evolving industry landscapes.

Ethiopia Emerges as a Major Player in Bitcoin Mining

A surprising development comes from Ethiopia, which is rapidly transforming into a significant force within global bitcoin mining circles according to wallstreet:online reports. Ranked low economically on international scales—with GDP per capita starkly contrasting developed nations—the country nonetheless made substantial strides, increasing capacity by an impressive 600 megawatts recently.

This expansion owes much credit to affordable electricity prices available locally—at a mere $0.53/kWh—which only a few countries worldwide can match or beat cost-wise, making it attractive ground especially post-China’s crackdown forcing many operators to seek new bases globally including Africa where Luxor spearheads initiatives leveraging modern rigs boosting Ethiopian hash rates considerably, now accounting for nearly two-and-a-half percent share internationally!

Strategic growth potential abounds here given favorable conditions alongside supportive governmental policies fostering conducive environments encouraging continued infrastructural enhancements. Ethiopia is poised to potentially position itself among continent-leading hubs soon enough should planned power grid expansions materialize successfully over the coming decade, promising exciting prospects ahead indeed!

Sources: