Table of Contents:

Bitcoin Market Update: Key Developments and Trends

The cryptocurrency market is currently facing significant challenges, particularly highlighted by the recent exit of the Gemini exchange from Europe. As reported by Business Punk, Gemini is shutting down its operations in Europe, the UK, and Australia, with customer accounts set to transition to payout mode by March 2026. The Winklevoss brothers, founders of Gemini, attribute this decision to a lack of market share outside the United States, indicating a strategic pivot back to the US market.

"The Krypto-Börse Gemini verlässt Europa, Großbritannien und Australien. Ab März 2026 werden Kundenkonten in den Auszahlungsmodus versetzt." - Business Punk

In parallel, the costs associated with Bitcoin mining have surged dramatically, with reports indicating that mining a single Bitcoin in Germany now costs around $200,000. This figure starkly contrasts with the current Bitcoin price of approximately $95,000, making mining operations financially unviable for many players in the market.

Get $500 free Bitcoin mining for a free testing phase:

- Real daily rewards

- 1 full month of testing

- No strings attached

If you choose to buy after testing, you can keep your mining rewards and receive up to 20% bonus on top.

Key Takeaway: The exit of Gemini from Europe and the skyrocketing mining costs signal a turbulent phase for the cryptocurrency sector, with only larger players likely to survive the ongoing market consolidation.

Marathon Digital Transfers Significant Bitcoin Holdings

In a notable transaction, Marathon Digital (MARA) has moved 1,318 BTC, valued at approximately $86.9 million, to various trading desks and exchanges. The largest transfer was made to Two Prime, a credit and trading firm, which received over 660 BTC. This movement comes amid a volatile market, raising concerns among traders about potential forced sales by miners.

Despite the significant transfers, analysts suggest that these movements may be part of routine treasury management rather than indicative of imminent spot sales. The current market conditions have seen Bitcoin prices drop nearly 50% from their peak of over $126,000, with the average mining cost reported at around $87,000.

Key Takeaway: The substantial transfer of Bitcoin by Marathon Digital highlights the ongoing volatility in the market, with miners facing increasing financial pressure as prices remain below production costs.

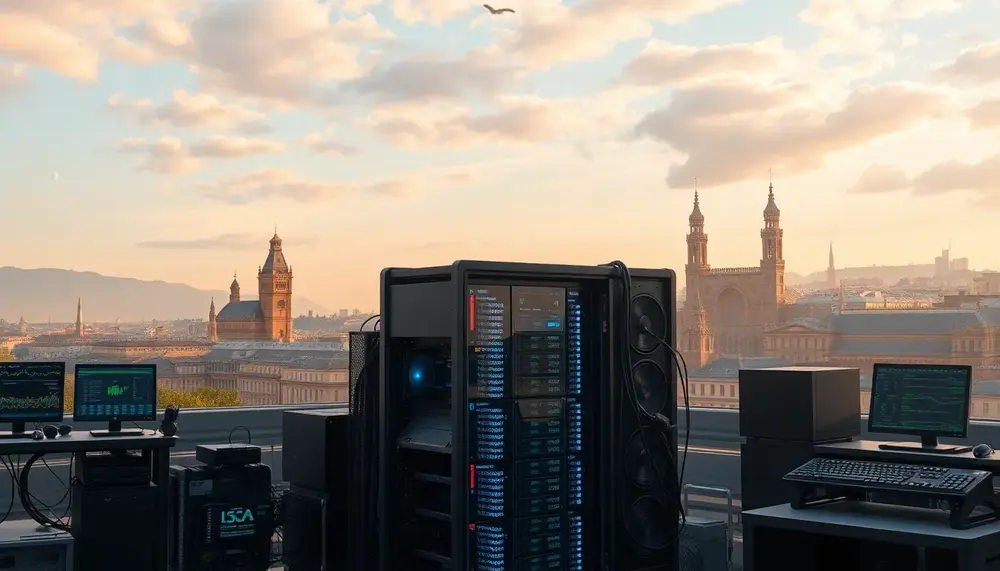

Crypto Blockchain Industries Invests in Bitcoin Mining and AI

Crypto Blockchain Industries has announced a €2 million investment in Bitcoin mining and AI server infrastructure. This strategic move reflects the company's commitment to expanding its operations in the cryptocurrency space, despite the current market challenges. The investment aims to enhance their capabilities in both sectors, potentially positioning them for future growth as the market stabilizes.

Key Takeaway: The investment by Crypto Blockchain Industries underscores a continued interest in Bitcoin mining and AI, suggesting that some companies are still looking to capitalize on opportunities within the cryptocurrency landscape.

Bitfarms Rebrands and Shifts Focus to AI

Bitfarms has announced a significant shift in its business strategy, declaring that it is "no longer a Bitcoin company." The firm plans to relocate its headquarters from Canada to the United States and rebrand as Keel Infrastructure, focusing on high-performance computing and artificial intelligence applications. This transition is part of a broader strategy to adapt to changing market conditions and investor sentiment.

Following the announcement, Bitfarms' stock surged by 18%, reflecting investor optimism about the company's new direction. The firm is also in the process of repaying a $300 million credit facility, starting with $100 million tied to its Panther Creek location.

Key Takeaway: Bitfarms' rebranding and strategic pivot towards AI signify a notable trend in the industry, where companies are increasingly diversifying their operations beyond traditional Bitcoin mining.

Sources:

- Wen der Bitcoin-Sturz als nächstes treffen könnte

- Kryptogeddon: Gemini flieht aus Europa – Mining kostet mehr als Bitcoin wert ist

- Analysten: Venezuelas Wiederaufleben der Ölindustrie könnte einen Boom beim Bitcoin-Mining mit abgefackeltem Gas einleiten

- Bitcoin-Miner MARA bewegt BTC im Wert von 87 Millionen US-Dollar zu verschiedenen Handelsdesks und Börsen

- Crypto Blockchain Industries investiert 2 Millionen Euro in Bitcoin-Mining und KI-Server

- Bitfarms (BITF) erklärt, es sei „kein Bitcoin-Unternehmen mehr“, da es unter neuem Namen in die USA umzieht